Oil Storage Market Report: Global Industry Size and Revenue Forecast 2030

Oil Storage Market: Trends, Growth Drivers, and Future Outlook 2024–2030

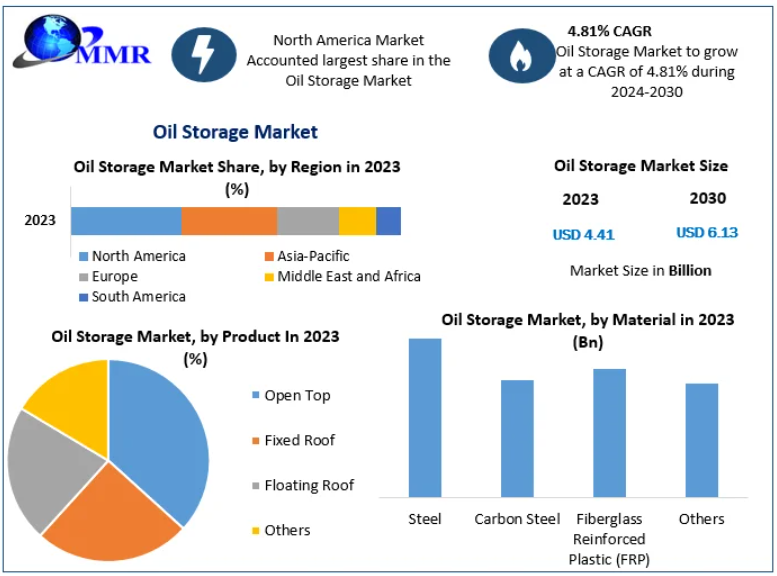

The Oil Storage Market was valued at USD 4.41 Billion in 2023 and is projected to reach USD 6.13 Billion by 2030, growing at a CAGR of 4.81% during the forecast period. The market encompasses storage solutions for crude oil, refined petroleum products, and other hydrocarbon derivatives, playing a pivotal role in the global oil and gas supply chain.

Market Overview

Oil storage involves the containment of processed oil in tanks and terminals, which may be located above or below ground. These tanks are designed to accommodate a variety of petroleum products such as crude oil, gasoline, diesel, aviation fuel, naphtha, LPG, and other derivatives. Materials commonly used in construction include stainless steel, carbon steel, reinforced concrete, and fiberglass, depending on the type of oil and its characteristics.

Oil storage plays a crucial role in the oil and gas industry, facilitating downstream operations such as refining, distribution, and strategic reserves. With growing global energy demands, especially in developing nations, the requirement for efficient and large-scale storage solutions is continuously increasing.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/44647/

Market Dynamics

Drivers

Growth of the Global Oil & Gas Industry

Expanding oil and gas production, particularly in developing countries such as Venezuela, Saudi Arabia, Iran, and Iraq, has fueled the demand for oil storage facilities. The need for large storage terminals to support refining hubs and import/export infrastructure is growing steadily.

Strategic Petroleum Reserves (SPRs)

Governments worldwide are investing in strategic petroleum reserves to ensure energy security during crises or supply disruptions. For instance, European nations maintain reserves equivalent to 90 days of average domestic consumption, directly boosting the demand for storage infrastructure.

Exploration and Offshore Activities

The rise in onshore and offshore exploration activities has created a need for temporary and permanent storage solutions for crude and refined oil products, further driving market expansion.

Restraints

High Construction and Maintenance Costs

The construction of storage terminals requires significant capital investment, while ongoing maintenance and safety compliance add to operational costs.

Shift Towards Renewable Energy

Growing adoption of renewable energy sources has led to reduced exploration and production in fossil fuels, potentially limiting long-term growth for oil storage facilities.

Opportunities

Technological Advancements in Storage Solutions

Innovations such as floating roof tanks, which minimize evaporative losses and corrosion, and fixed roof tanks for enhanced containment, offer growth potential. Companies are investing in advanced materials and automation to improve efficiency, safety, and environmental compliance.

Rising Trade of Oil Products

Global oil trade has increased substantially, prompting investment in storage terminals in strategic locations to accommodate imports and exports. This trend is particularly prominent in North America, the Middle East, and Asia-Pacific.

Market Segmentation

By Product Type

- Fixed Roof Tanks: Held the largest market share (42% in 2023) due to low installation costs and high containment efficiency.

- Floating Roof Tanks: Expected to grow at CAGR of 5.1%, driven by reduced evaporative losses and better handling of low-flashpoint hydrocarbons.

- Open Top and Others: Used for specialized applications in certain regions.

By Application

- Crude Oil: Largest segment, accounting for 52.7% of the market in 2023.

- Gasoline: Expected to grow at CAGR of 6.2%, driven by high combustion energy requirements for automobiles and industrial equipment.

- Middle Distillates, Aviation Fuel, and Others: Increasing demand for refined products supports market growth.

By Material

- Carbon Steel

- Fiberglass Reinforced Plastic (FRP)

- Stainless Steel

- Others

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/44647/

Regional Insights

- North America: Largest market, with 32.4% share, driven by increasing energy demand and expanding storage terminals in the U.S., Canada, and Mexico.

- Middle East & Africa: Accounts for 25.1% of the market, fueled by oil production growth in Saudi Arabia, UAE, and Kuwait.

- Europe: Investments in SPRs and refinery expansion support steady growth.

- Asia-Pacific: Rising industrialization and energy demand create new opportunities in India, China, and Southeast Asia.

- South America: Expanding refining infrastructure in countries like Brazil and Venezuela contributes to market growth.

Competitive Landscape

The global oil storage market is competitive, with key players focusing on innovation, operational efficiency, and regional expansion. Major companies include:

- CST Industries

- ZCL Composites, Inc.

- Synder Industries

- Denali Incorporated

- Synalloy Corporation

- LF Manufacturing

- Superior Product Company, Inc.

- Tianjin Anson International Co., Ltd.

- Roth Industries Company

- Vopak

- Oiltanking GmbH

- Poly Processing

…and others focusing on both domestic and international markets.

These players prioritize R&D, product innovation, and strategic partnerships to cater to the increasing demand for high-capacity and technologically advanced storage solutions.

Conclusion

The Oil Storage Market is poised for steady growth through 2030, driven by rising global energy demand, strategic petroleum reserves, and expansion in refining and trading infrastructure. While challenges such as high costs and the transition toward renewable energy exist, advancements in storage technology, regional investments, and rising trade volumes present strong growth opportunities.

The market is expected to remain competitive, with innovation and strategic expansion shaping its future trajectory, making oil storage a critical component of the global energy supply chain.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness