GPS Tracker Market Outlook Shaped By Logistics Digitization And IoT Platforms

The GPS Tracker market growth is expanding as organizations prioritize visibility, security, and operational control across vehicles, assets, and mobile workforces worldwide. Businesses increasingly adopt location-enabled hardware and software to reduce theft risk, improve route planning, and verify service delivery in real time. Consumer demand also supports adoption through personal safety devices, pet trackers, and connected-car features. In many regions, tighter compliance expectations for commercial transport, cold-chain logistics, and duty-of-care programs are accelerating deployments. Modern platforms combine satellite positioning with cellular connectivity, cloud dashboards, and mobile apps to deliver actionable alerts and historical reporting. As device costs decline and battery performance improves, more use cases become economically viable for small and mid-sized operators. Competitive differentiation is shifting from basic tracking to analytics, geofencing, and integrated workflow tools. These factors collectively reinforce strong momentum for broader market penetration.

Buyers evaluate solutions by accuracy, uptime, battery life, form factor, and total cost of ownership over multi-year deployments. Hardware selection often depends on the asset category: hardwired units for trucks, OBD devices for light vehicles, and compact battery-powered trackers for containers, equipment, and high-value goods. Subscription models typically bundle connectivity, platform access, and support, making long-term service reliability a core purchasing concern. Organizations also compare installation effort, device ruggedness, and certifications for harsh operating environments. Increasingly, procurement teams require integration with existing fleet management, ERP, dispatch, and maintenance systems through APIs. For consumer products, ease of use, privacy controls, and app performance become decisive. Vendors that offer flexible plans, strong customer onboarding, and responsive support tend to retain accounts longer. Across segments, accurate alerting—such as ignition detection, vibration events, and tamper notifications—continues to drive perceived value.

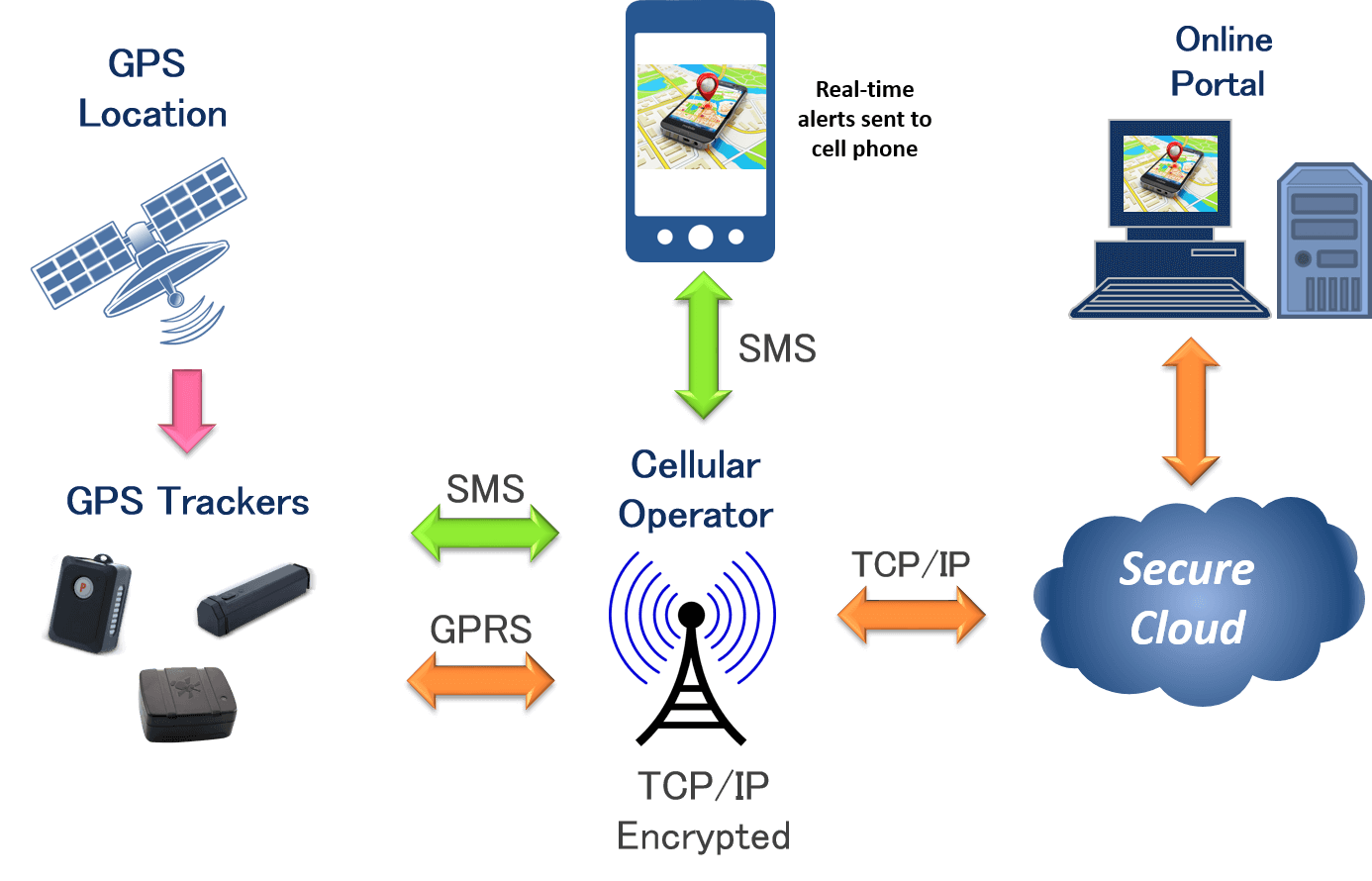

Technology evolution is reshaping the feature set expected from tracking platforms. Multi-constellation GNSS support, assisted GPS, and improved antennas boost performance in dense urban areas and partially covered locations. Connectivity options now extend beyond 4G/5G to include LPWAN technologies, enabling longer battery life for low-reporting asset trackers. Edge processing helps devices filter noise and trigger events without constant cloud communication, reducing bandwidth and power consumption. Software improvements include predictive maintenance signals, driver behavior scoring, and automated exception reporting to focus teams on urgent issues. Cybersecurity is also gaining attention, with stronger authentication, encrypted data paths, and device management controls becoming standard enterprise requirements. Meanwhile, AI-assisted analytics is emerging to optimize routing, reduce idle time, and detect suspicious patterns. As interoperability improves, customers expect trackers to plug into broader telematics and IoT ecosystems with minimal custom development.

Regulation and privacy expectations influence how deployments are designed and communicated. Employers implementing workforce tracking must define clear policies, ensure lawful processing, and provide transparency around what data is collected and why. In fleet settings, balancing safety objectives with driver trust can determine program success, especially when behavior monitoring is involved. Data retention practices, role-based access, and audit logs help reduce risk while supporting compliance. Vendors that provide configurable privacy features and regional hosting options can better address multinational requirements. Looking ahead, market growth should remain supported by logistics expansion, e-commerce delivery density, and rising asset security needs. The most successful offerings will align reliable hardware with intuitive software, meaningful analytics, and dependable service operations. In short, the market is moving from “where is it?” to “what should we do next?”—and that shift will shape product roadmaps and buying decisions.

Top Trending Reports:

Encryption Management Solution Market

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness