-

Новости

- ИССЛЕДОВАТЬ

-

Страницы

-

Группы

-

Мероприятия

-

Статьи пользователей

-

Offers

-

Jobs

-

Courses

India Automotive Aftermarket Industry Report: Competitive Landscape and Key Players 2030

India Automotive Aftermarket: Trends, Drivers, and Growth Opportunities

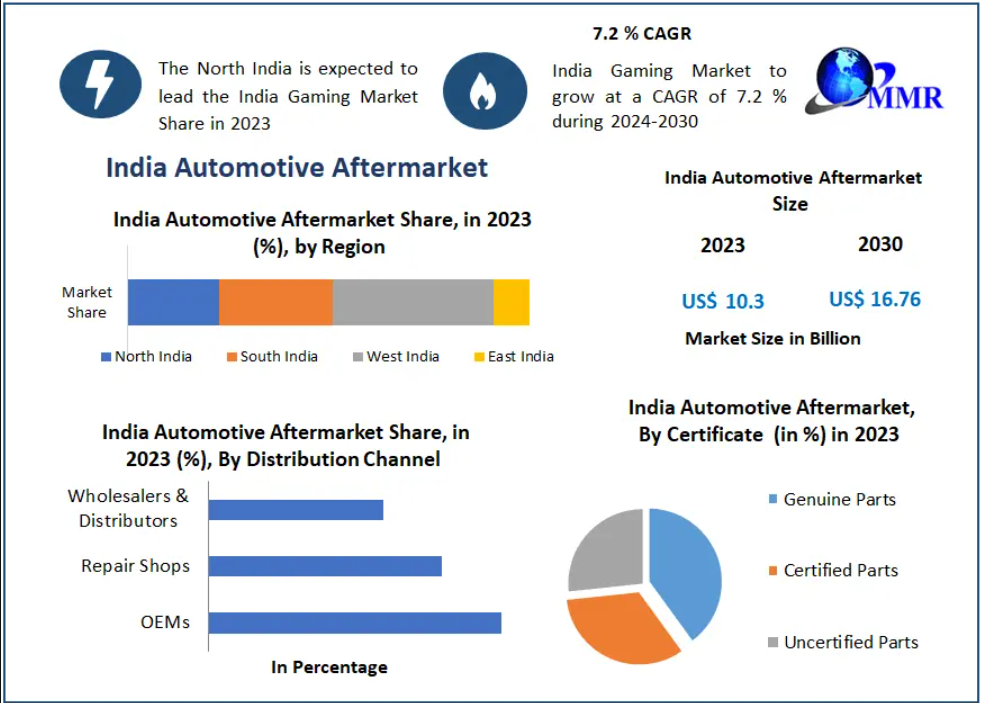

The India Automotive Aftermarket is poised for robust growth, with the market valued at USD 10.3 billion in 2023 and expected to reach nearly USD 16.76 billion by 2030, registering a CAGR of 7.2%. This growth is underpinned by the expanding vehicle parc, which currently stands at 340 million units and is forecasted to grow steadily over the next five years. The two-wheelers and passenger vehicles segments are set to see significant expansion, with two-wheelers projected to rise from 257 million to 365 million units, and passenger vehicles from around 47 million to over 72 million units.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/29939/

Market Dynamics

Strong Growth Drivers

A key driver of the aftermarket’s growth is the surge in vehicle sales, particularly in two-wheeler, three-wheeler, and passenger vehicle segments. In January 2024, overall vehicle sales in India increased by 15%, reaching 21.27 lakh units, with two-wheelers leading at 14.58 lakh units and three-wheelers surging by 37%. The increasing demand in rural regions, supported by favorable agricultural conditions and government initiatives, also contributes to aftermarket expansion. Moreover, the growing pre-owned car market is expected to register a CAGR of 17.5% by 2030, fueled by organized players and online platforms, providing additional growth avenues for aftermarket businesses.

Transformative Trends

The Indian aftermarket is witnessing a shift in business models and revenue streams. Traditional sequential selling is giving way to direct-to-consumer distribution via e-commerce platforms, facilitated by collaborations between OEMs and online giants like Amazon and eBay. While wear-and-tear parts have historically dominated, the focus is shifting to diagnostics, predictive maintenance, and connected vehicle services. IoT sensors and vehicle data enable proactive maintenance, allowing aftermarket players to offer more sophisticated, value-added services.

Opportunities from Technological Advancements

The rise of connected vehicles, electric vehicles (EVs), and ADAS (Advanced Driver Assistance Systems) presents vast opportunities. Aftermarket businesses can tap into services like remote diagnostics, predictive maintenance, battery management, retrofitting, and calibration of ADAS features. Furthermore, innovations in materials, 3D printing, and manufacturing processes allow for the creation of custom components, accessories, and performance upgrades, catering to an increasingly tech-savvy consumer base.

Challenges and Market Restraints

Despite the promising growth, the aftermarket faces constraints due to a strict regulatory environment. Compliance with safety, emission, and manufacturing standards, along with certifications from BIS and AIS, increases costs and creates barriers for new entrants. Additionally, heavy regulation may limit product innovation, favor larger established players, and complicate international trade. Navigating these hurdles is essential for aftermarket businesses seeking sustainable growth.

Segment Analysis

Among replacement parts, the tire segment dominates the market due to consistent demand driven by regular wear and tear across passenger vehicles, commercial vehicles, and two-wheelers. Other prominent segments include batteries, brake parts, filters, body parts, lighting components, wheels, exhaust systems, and turbochargers. Certified and genuine parts remain preferred by consumers, although uncertified parts continue to have a presence in certain market segments.

by Replacement Parts

Tire

Battery

Brake Parts

Filters

Body parts

Lighting & Electronic Components

Wheels

Exhaust components

Turbochargers

Others

by Certification

Genuine Parts

Certified Parts

Uncertified Parts

by Service Channel

DIY (Do it Yourself)

DIFM (Do it for Me)

OE (Delegating to OEM’s)

by Distribution Channel

OEMs

Repair Shops

Wholesalers & Distributors

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/29939/

Regional Insights

The Northern region leads the automotive aftermarket in India, with strong demand coming from states like Delhi, Uttar Pradesh, Punjab, and Haryana. Factors such as high vehicle density, urbanization, and agricultural activities contribute to this dominance. The Western region, including Maharashtra, Gujarat, and Rajasthan, also shows significant market potential, driven by industrial hubs, automotive clusters, and rising disposable incomes in cities like Mumbai and Pune.

Key Market Players

The India Automotive Aftermarket is highly competitive, with major players including:

- Bosch India

- TVS Group

- Mahindra & Mahindra

- Exide Industries

- Tata Motors

- Minda Industries

- Amara Raja Batteries

- Ashok Leyland

- Hero MotoCorp

- Maruti Suzuki

- Motherson Sumi Systems

- JK Tyre & Industries

- Lumax Industries

- Sundram Fasteners

- WABCO India

- Gabriel India

- Ceat Ltd.

- SKF India

- MRF Limited

- Apollo Tyres

Conclusion

The India Automotive Aftermarket is entering a period of transformation and rapid growth. Rising vehicle sales, technological advancements, the growing pre-owned car segment, and evolving consumer preferences are creating multiple growth avenues. At the same time, challenges such as regulatory compliance, inventory management, and market fragmentation must be addressed strategically. Companies that leverage digitization, connected vehicle data, and innovative aftermarket solutions will be best positioned to capture the vast potential in India’s expanding automotive ecosystem.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness