Shipbuilding Market Challenges and Barriers Facing Global Shipyards 2032

Global Shipbuilding Market Outlook (2025–2032): Growth Prospects, Trends, and Regional Insights

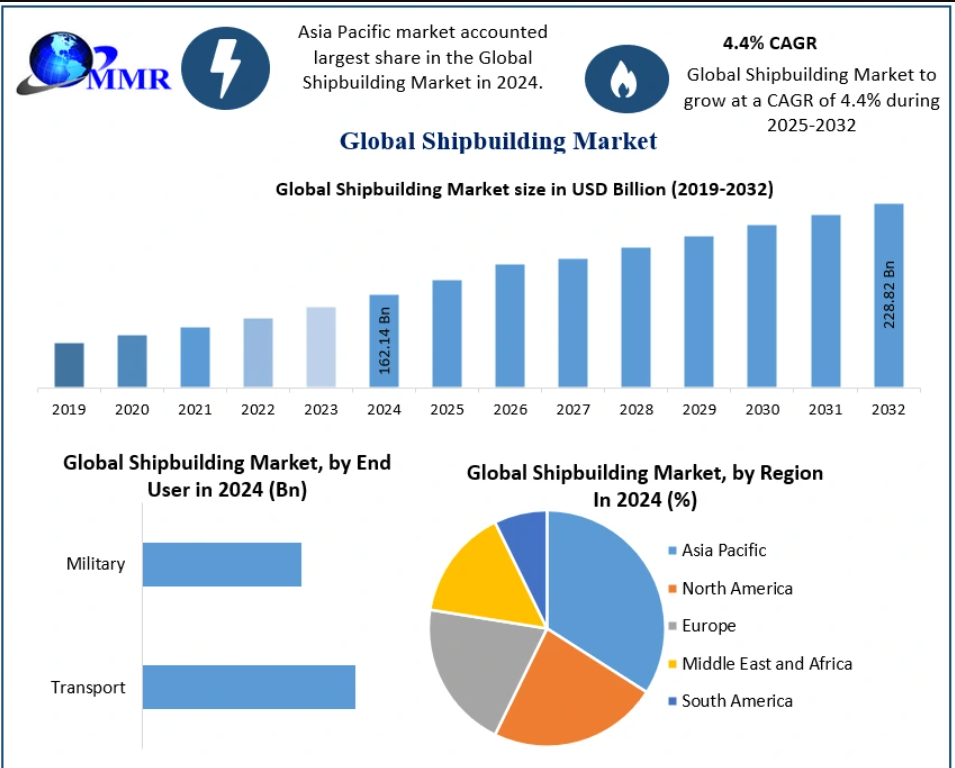

The Global Shipbuilding Market, valued at USD 162.14 billion in 2024, is projected to reach USD 228.82 billion by 2032, registering a CAGR of 4.4% during the forecast period. Shipbuilding—a discipline that blends engineering, innovation, and strategic manufacturing—remains a cornerstone of global trade, military strength, and offshore energy operations.

Market Overview

Shipbuilding involves the construction of ships and floating vessels within specialized facilities known as shipyards. Historically, shipbuilding was driven by craftsmanship and experiential knowledge. Over the past two centuries, advancements in hydrostatics, hydrodynamics, and materials science have transformed shipbuilding into a sophisticated engineering-heavy industry.

Today’s shipyards build a wide variety of vessels including:

- Cargo carriers

- Oil tankers

- Bulk carriers

- Container ships

- Passenger and cruise ships

- Naval vessels

The industry supports global supply chains, defense capabilities, and maritime transportation networks essential to international commerce.

Access your free report sample — uncover the top-performing segments today:https://www.maximizemarketresearch.com/request-sample/148775/

Impact of COVID-19

The COVID-19 pandemic significantly disrupted the shipbuilding sector. The industry was already grappling with environmental regulatory uncertainties and consolidation pressures, and the pandemic intensified these challenges.

Major pandemic-driven impacts:

- Supply chain breakdowns caused delays in vessel construction and maintenance.

- Temporary shutdowns of major shipyards in Asia, Europe, and North America.

- Reduced workforce availability, leading to project backlogs.

- Decline in new orders, especially during the first half of 2020.

Several shipyards faced closures or downsizing:

- Samsung Heavy Industries closed its 26-year-old Ningbo shipyard (China).

- Irving Shipbuilding issued layoff notices to over 1100 employees during temporary shutdowns.

Despite these setbacks, government support for maritime transport and commercial trade prevented a deeper decline. By late 2021, recovery began as demand for cargo vessels, LNG carriers, and naval ships increased.

Market Dynamics

1. Growth Drivers

➤ Rising Global Seaborne Trade

Around 80% of global trade by volume relies on maritime transport. Growing economic activity, industrialization, and expanding consumer markets drive demand for new vessels.

➤ Technological Advancements

Innovations shaping modern shipbuilding include:

- Fuel-efficient engines

- Multi-fuel propulsion (LNG, methanol, hydrogen)

- Autonomous navigation

- Smart ship technologies

- 3D printing of components

These developments enhance operational efficiency and safety.

➤ Growing Importance of Marine Transportation

Cargo congestion, increased e-commerce demand, and globalization amplify the need for advanced cargo vessels, fueling shipbuilding investments.

➤ Defense Modernization Programs

Rising geopolitical tensions and maritime security requirements drive substantial demand for naval ships and submarines.

2. Market Restraints

The sector faces several challenges:

- High cost of raw materials (steel, alloys, composite materials)

- Rising environmental regulations (IMO 2020, GHG reduction targets)

- Skilled labor shortages

- Long construction cycles

- Operational cost volatility

These factors may hinder expansion, especially for smaller shipyards.

3. Opportunities

The market is seeing new opportunities in:

- Autonomous and unmanned vessels

- Big data analytics and drone-based maintenance

- Green shipbuilding technologies

- Expansion of naval fleets due to increased defense budgets

- LNG and alternative fuel-powered ship demand

Market Segment Analysis

1. By Type

Cargo Ships

Expected to witness the highest CAGR due to rising global logistics and commodity demand.

Container Ships

Growth supported by increasing e-commerce and high operational efficiency.

Oil Tankers

Steady demand as global energy trade remains robust.

Bulk Carriers

Boosted by iron ore, coal, and agricultural commodity trade.

Passenger Ships

Driven by resurgent maritime tourism and luxury cruise sectors.

2. By End User

Transport (Dominant Segment)

Representing the majority share due to commercial shipping, logistics, and trade movement.

Military

Expected to grow at a substantial CAGR, supported by:

- Naval modernization

- Rising maritime disputes

- Increasing defense procurement budgets

Access your free report sample — uncover the top-performing segments today:https://www.maximizemarketresearch.com/request-sample/148775/

Regional Insights

1. Asia-Pacific (APAC) – The Global Leader

APAC accounted for 82% of the global shipbuilding market in 2024.

Key highlights:

- China dominates global shipbuilding orders, with over 50% of global CGT.

- South Korea leads in LNG carrier construction—its high-value specialization.

- Japan remains a key contributor with a strong portfolio in bulk carriers and container vessels.

South Korea’s major contracts include:

- 37 LNG carrier contracts in 2022

- 16 vessels for Qatar Energy

- 15 carriers for Petronas

2. Europe

Expected to grow at a CAGR of 4.4%.

Europe remains a powerhouse in:

- Cruise ship manufacturing

- High-tech naval vessels

- Specialized engineering ships

Daewoo Shipbuilding & Marine Engineering (DSME) received over USD 1.5 billion in orders from European companies in 2022.

3. North America

Growth supported by naval shipbuilding programs and offshore energy expansion.

4. Middle East & Africa

Increasing investment in naval fleets and port expansions boosts market demand.

5. South America

Brazil and Argentina drive regional growth through commodity exports and maritime trade investment.

Key Market Players

Major companies shaping the global shipbuilding landscape include:

- Raytheon Technologies Corporation

- Huntington Ingalls Industries, Inc.

- General Dynamics Corporation

- Damen Shipyards Group

- BAE Systems

- STX Offshore & Shipbuilding Co., Ltd.

- Sumitomo Heavy Industries, Ltd.

- FINCANTIERI S.p.A.

- China State Shipbuilding Corporation Limited

- DSME Co., Ltd.

- China Shipbuilding Industry Corporation

- United Shipbuilding Corporation

- Larsen & Toubro Limited

- NorthStar Shipbuilding Pvt. Ltd.

- Tsuneishi Shipbuilding Co., Ltd.

Conclusion

The global shipbuilding market is entering a transformative phase driven by:

- Rising seaborne trade

- Technological innovation

- Defense modernization

- Growing demand for greener vessels

APAC will continue its dominance, while Europe and North America focus more on high-value naval and specialized ships. With advancements in automation, fuel technologies, and smart ship systems, the industry is expected to experience steady and sustainable growth through 2032.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness