UAV Battery Industry Analysis: Market Size, Share & Growth Forecast to 2035

Market Outlook

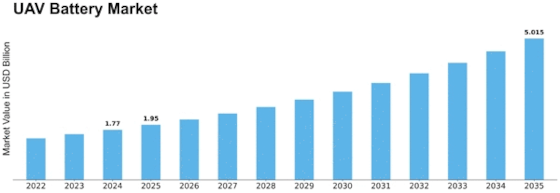

The battery segment of UAVs is forecast to grow robustly, with UAV Battery Market valuations rising from around USD 1.61 billion in 2023 to about USD 5.0 billion by 2035 — a CAGR of roughly 9.9%. This growth is a reflection not just of increasing UAV quantity but of advancing mission complexity — from simple aerial imaging to beyond-visual-line-sight (BVLOS) delivery, heavy-lift cargo drones, and defence reconnaissance missions.

Industry Overview

In the UAV battery realm, innovation is everything. Batteries need to be lighter, pack more energy, charge faster and offer greater reliability under demanding conditions. The interplay between battery cell chemistry (lithium-ion, lithium-polymer, fuel cell, etc), pack architecture (modular vs fixed), thermal management, and battery management systems is driving rapid change. For UAVs, the battery solution is no longer a generic off-the-shelf pack, but a mission-specific power system engineered for flight. Market drivers include increasing drone adoption in commercial logistics, agriculture, infrastructure inspection, and military applications — all of which require higher performance batteries. Sustainability concerns (recyclability, lower carbon footprint) are also influencing design.

Key Players

Leading players in the UAV battery market include:

- VARTA AG – major European player with UAV-specific battery chemistry and partnerships.

- Sion Power Corporation – innovator in lithium-metal cells intended for UAV endurance.

- Ballard Power Systems – entering UAV battery segment via fuel-cell modules.

- Broader contributors: Panasonic, Samsung SDI, LG Energy Solution, Saft Groupe, A123 Systems. Some of these also serve the wider battery industry but are increasingly active in UAV applications.

Segmentation Growth

Key segmentation dimensions demonstrating growth: - Battery Type: The dominance of lithium-ion continues, but the market is shifting toward higher energy density chemistries and modular pack solutions. Graduating from lead-acid and nickel-cadmium (once found in simpler systems) to lithium-polymer and emerging technologies is a clear trend.

- Application Segment: The commercial sector (logistics, inspection, agriculture) is growing particularly strongly. According to one source, the commercial application segment was about USD 0.68 billion in 2024 and aimed to reach ~USD 1.88 billion by 2035.

- Voltage Range / System Scale: For heavier UAVs (industrial, cargo, defence), voltage ranges above 48 V are becoming more common; whereas lightweight consumer drones remain in sub-12 V or 12-24 V ranges.

- Regional Growth: Asia-Pacific stands out as a high-growth region, driven by commercial UAV use in agriculture, logistics, inspection and surveillance. North America remains the largest market in absolute terms, backed by defence spending and mature UAV ecosystems.

Closing Thoughts

For battery manufacturers, the UAV segment presents an attractive opportunity — but one with stringent demands. Success will require not just incremental improvements, but step-change innovations in energy density, weight, cost and systems integration. Partnerships with UAV OEMs, and alignment to high-end mission profiles, will separate the winners from the rest.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness