Financial App Market Trends Transforming Mobile Banking and Payments 2032

Financial App Market: Driving Smarter, Digital-First Financial Decisions

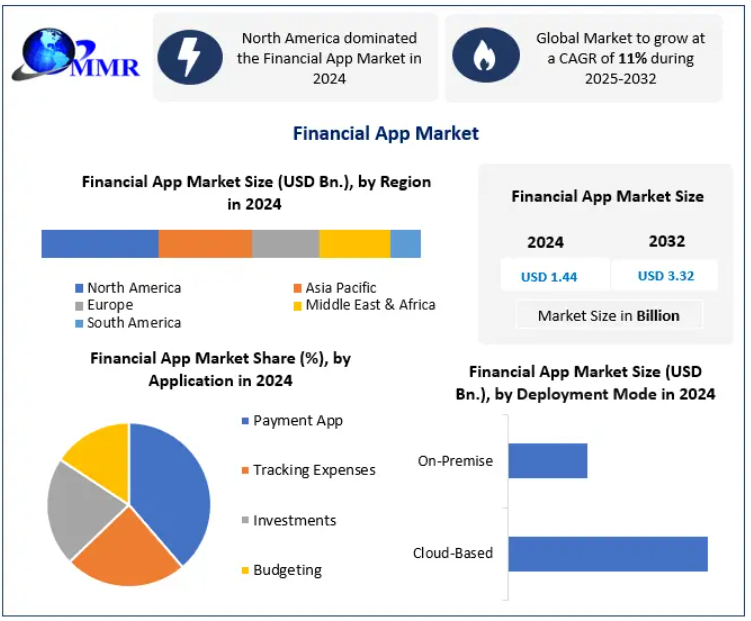

The global Financial App Market was valued at USD 1.44 billion in 2024 and is projected to expand at a CAGR of 11% from 2025 to 2032, reaching approximately USD 3.32 billion by 2032. The market’s growth is strongly supported by rising demand for digital banking solutions, widespread smartphone adoption, and the growing integration of business intelligence (BI) and analytics into financial decision-making platforms.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/147688/

Financial App Market Overview

A financial app is a mobile or web-based software application designed to perform specific financial functions such as expense tracking, fund transfers, investment management, budgeting, and account monitoring. These applications simplify day-to-day financial operations for both individuals and organizations by offering real-time access to financial data and insights.

Financial apps are now an essential component of modern financial ecosystems, supporting activities such as auditing, compliance management, risk assessment, analytics, reporting, and consultation. As financial institutions rapidly adopt digital transformation strategies, financial apps have emerged as critical tools for enhancing customer experience, operational efficiency, and data-driven decision-making.

Financial App Market Impact of COVID-19

The COVID-19 pandemic significantly reshaped the global financial landscape. During the initial phase of the pandemic, both domestic and international financial activities slowed due to economic uncertainty and restricted mobility. However, the crisis accelerated the shift from physical transactions to digital financial services.

As consumers and enterprises increasingly relied on online banking, digital payments, and app-based financial services, demand for financial apps surged. Subscription-based financial applications witnessed rapid growth, particularly for daily transactions, digital wallets, and online banking services. This behavioral shift has created long-term growth opportunities for the financial app market.

Financial App Market Dynamics

Market Opportunities

The rapid digitalization across industries presents substantial growth opportunities for the financial app market. As organizations generate massive volumes of financial data, the need for advanced analytics and real-time insights has become critical. Financial apps equipped with BI capabilities enable accurate forecasting, KPI tracking, reporting, and performance monitoring.

Additionally, financial institutions and major market players are actively investing in advanced app development, awareness programs, and feature-rich platforms to improve customer engagement. The increasing adoption of big data analytics and AI-driven insights is expected to further accelerate market expansion.

Market Drivers

The growing preference for cloud-based financial applications is a major driver of market growth. Cloud deployment allows financial organizations to access real-time performance data, analytics, and insights with enhanced scalability and flexibility. These platforms also support risk management, monitoring, and intelligence functions while handling large volumes of structured and unstructured data.

Financial apps provide comprehensive reporting tools that enable banks, accounting firms, and financial institutions to analyze market trends, manage risks, and improve operational efficiency. Features such as alerts, transaction notifications, and automated insights are further boosting adoption among enterprises and individual users.

Market Challenges

Despite strong growth prospects, the financial app market faces challenges related to data privacy and cybersecurity. Financial apps store highly sensitive information such as banking credentials, card details, passwords, and transaction histories. Any data breach or unauthorized access can result in severe financial and reputational losses.

The increasing use of cloud-based storage and analytics platforms further intensifies security concerns, making robust data protection frameworks and compliance standards essential for market sustainability.

Market Restraints

Regulatory compliance remains a significant restraint for the financial app market. Financial applications must adhere to strict regional and international regulations, standards, and governance frameworks. Frequent changes in compliance requirements can increase operational complexity and slow adoption.

Additionally, improper app management or lack of technical expertise can lead to financial misjudgments, reducing trust among users and limiting market growth.

Financial App Market Segment Analysis

By Type

The banking segment dominated the financial app market in 2024, driven by the rapid adoption of digital banking services. Changing consumer behavior, particularly among Millennials and Generation Z, along with the long-term effects of the pandemic, has accelerated the transition from physical banking to mobile-first solutions.

Banking apps offer features such as balance inquiries, transaction history, bill payments, fund transfers, ATM locators, budgeting tools, mobile check deposits, and account management. These functionalities have made banking apps the most valuable financial tools for consumers.

The stock trading segment is also experiencing steady growth. Trading apps provide real-time and historical market data, technical and fundamental analysis, forecasting tools, educational resources, and news updates. Platforms such as Webull, Ameritrade, and Lightspeed Trading enable informed investment decisions and portfolio optimization.

By Application

The payment app segment led the Financial App Market in 2024, owing to its widespread adoption across both developed and emerging economies. The growing penetration of smartphones, QR-code payments, and digital wallets such as Google Pay, Apple Pay, and Paytm has significantly boosted market growth.

Government initiatives promoting cashless transactions, particularly in the post-pandemic era, along with the convenience of peer-to-peer transfers, contactless payments, and bill management, have positioned payment apps as the most widely used financial applications globally.

By Market Size

Small businesses represent a key user base for financial apps. Accounting platforms such as QuickBooks Online, FreshBooks, and Wave Accounting offer cost-effective, cloud-based financial management solutions. These apps enable small businesses to track cash flow, manage invoices, control expenses, and access customer support, making them essential tools for growing enterprises.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/147688/

Financial App Market Regional Insights

The Asia Pacific region dominated the market, accounting for a 45% share in 2022, and is expected to continue growing steadily throughout the forecast period. Strong adoption of business intelligence solutions in China, rising demand for risk management tools in India, and rapid digital banking expansion are key growth drivers.

Europe and South America are also witnessing increasing adoption of financial apps due to rising fintech investments and regulatory support. Meanwhile, the Middle East and Africa region is projected to grow at a CAGR of 13.6%, driven by growing demand for peer-to-peer investment and digital payment apps, particularly in Saudi Arabia.

Financial App Market Competitive Landscape

The Financial App Market is moderately fragmented, with the presence of global leaders, emerging fintech firms, and specialized app developers. Companies are focusing on cloud integration, AI-driven analytics, enhanced security, and user-centric design to strengthen their market position.

Key players operating in the market include:

- Appello Pty. Ltd.

- Arateg

- Emizen Tech

- NIX United

- Shakuro

- ArkaSoftwares

- Peerbits

- Endive Software

- Diceus

- Sidebench Studios

- Intuit

- Personal Capital Corporation

- Acorns Grow

- Robinhood Financial

- Wealthfront Inc.

- Credit Karma Inc.

Financial App Market Report Scope

The report provides a comprehensive analysis of the global Financial App Market, covering market size, trends, dynamics, segmentation, regional performance, and competitive strategies. It includes PORTER’s Five Forces and PESTEL analysis, offering valuable insights into macroeconomic and microeconomic factors influencing market growth.

By presenting complex data in a simplified format, the report serves as a strategic guide for investors, policymakers, and industry stakeholders seeking to understand market opportunities, risks, and future growth potential.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness