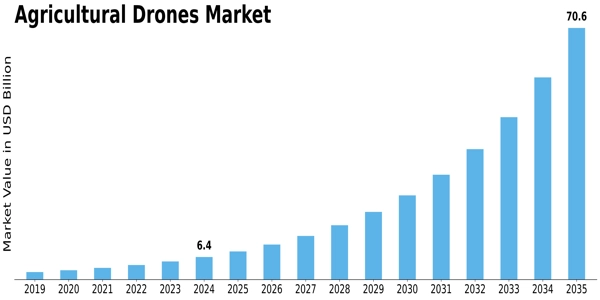

Agriculture Drones Market Outlook 2025–2035: Automation Reshapes Farming Practices

The MRFR report provides valuable segmentation and geographic breakdowns, which help stakeholders identify which sub-segments (product, component, application, region) offer the largest size, fastest growth, and most promising share potential.

Product Segmentation (fixed-wing, rotary-blade, hybrid)

MRFR identifies three primary product types: Fixed-Wing Drones, Rotary-Blade Drones, and Hybrid Drones.

For example, fixed-wing drones were valued at USD 1.9 billion in 2024 and are projected to expand to USD 22.7 billion by 2035.

This suggests that within the overall industry, fixed-wing platforms (which typically cover larger areas) are gaining traction, especially for large-scale farming operations.

Component Segmentation (Hardware, Software)

The MRFR overview segments the market into hardware (drones, sensors, payloads) and software (analytics, mapping platforms).

This segmentation reinforces that the industry is as much about data and analytics as about the physical drones — participants in either component can target growth.

Application Segmentation (Irrigation Monitoring, Soil & Crop Analysis, Planting & Spraying, Field Mapping, Crop Scouting, Others)

MRFR lists multiple applications within agriculture drones: irrigation monitoring, soil & crop-field analysis, planting & pesticide spraying, field mapping, crop scouting.

This diversity means firms can specialise in one application (say spraying) or offer bundled solutions across multiple application verticals.

Regional Segmentation

Regionally, MRFR provides a breakdown across North America, Europe, Asia-Pacific, South America, Middle East & Africa (MEA).

Key data points:

- North America: valued at ~USD 1.5 billion in 2024; projected to reach ~USD 17.23 billion by 2035.

- Europe: ~USD 1.2 billion in 2024; projected ~USD 14.07 billion by 2035.

- Asia-Pacific: ~USD 2.6 billion in 2024; projected ~USD 25.82 billion by 2035.

- South America: ~USD 0.8 billion in 2024; projected ~USD 9.32 billion by 2035.

- MEA: ~USD 0.26 billion in 2024; projected ~USD 4.93 billion by 2035.

Interpretation & Strategy

From an industry-analysis and market-share perspective:

- Asia-Pacific offers the largest absolute growth and hence a big share gain opportunity.

- Fixed-wing drones appear to be a strong sub-segment in product type.

- Applications like spraying and mapping may grow rapidly and capture higher share.

- Software component may see higher growth rate versus hardware over time, as value shifts from hardware to analytics.

- Regional strategies must adapt: North America & Europe may offer mature markets with higher unit cost, whereas APAC and South America offer volume growth albeit perhaps at lower margin.

In summary: segmentation and regional analysis in the agriculture drones market illuminate where the size is, how the share is distributed, how growth varies by sub-segment, what trends are in each region, and how the forecast will evolve. Stakeholders should align their product portfolios, regional focus, applications and business models accordingly.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness