Global Solid Phase Extraction (SPE) Market to Reach US$ 794.02 Million by 2032

Global Solid Phase Extraction (SPE) Market to Reach US$ 794.02 Million by 2032, Driven by Rising Demand in Pharma, Environmental & Clinical Testing

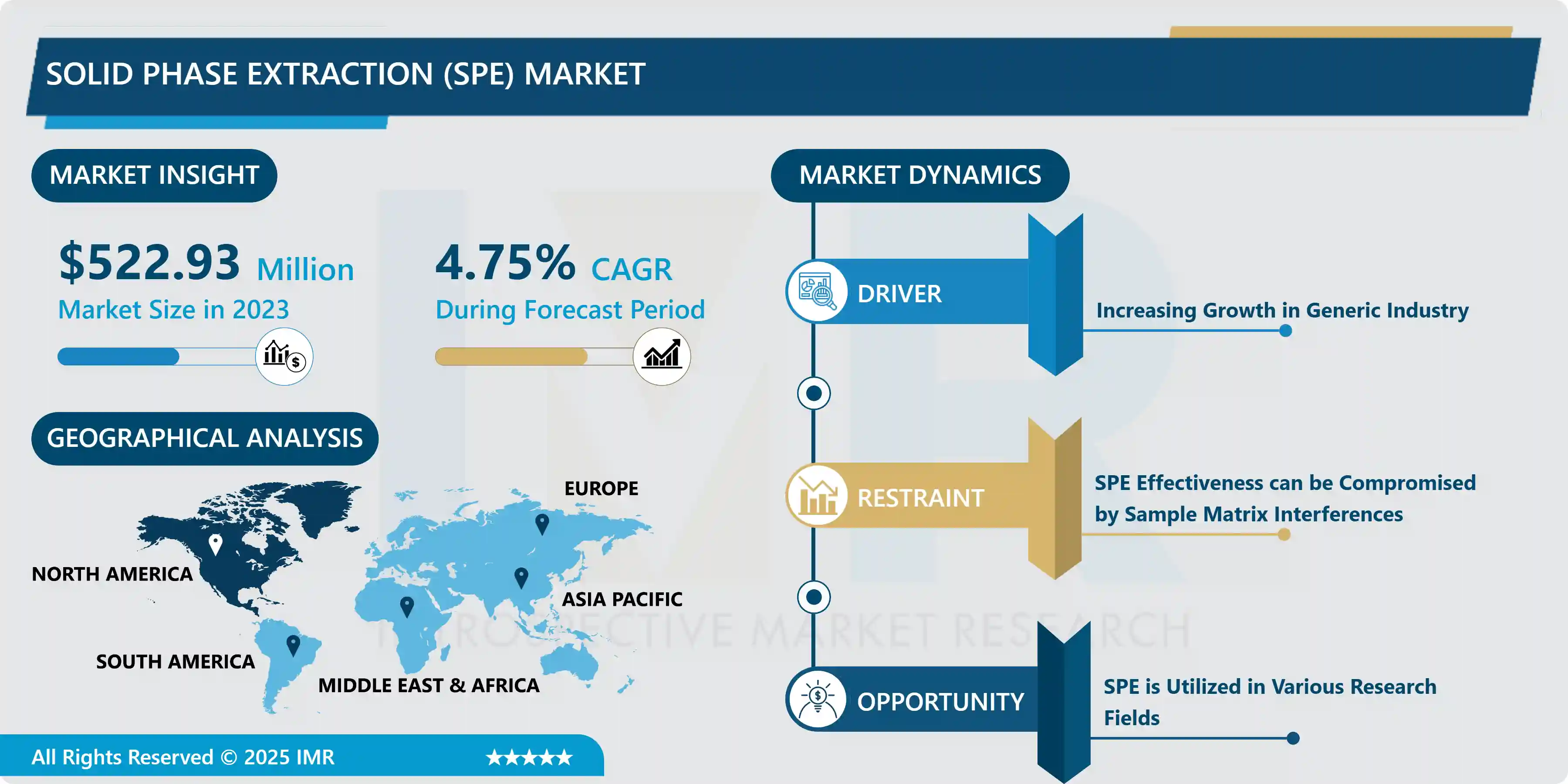

Introspective Market Research (IMR) today released a comprehensive analysis of the global Solid Phase Extraction (SPE) Market, forecasting a rise from US$ 522.93 million in 2023 to US$ 794.02 million by 2032, representing a compound annual growth rate (CAGR) of 4.75% over the 2024-2032 period.

The market’s steady expansion is being driven by increasing demand for precise sample preparation techniques across pharmaceuticals, environmental testing, food safety, clinical diagnostics, and research laboratories worldwide. Regulatory pressure, rising generic drug production, and the need for higher analytical sensitivity and reproducibility are among the top-line drivers.

Quick Insights

- 2023 Market Size: US$ 522.93 million

- Forecast (2032): US$ 794.02 million

- CAGR (2024–2032): 4.75%

- Dominant Product Type: SPE Cartridges (preferred for simplicity, consistency, scalability)

- Leading Application Segment (2023): Pharmaceutical & Biotechnology Industries ~48.67% share

- Region With Largest Market Share & Dominance: North America

- Key Players in Competitive Landscape: Thermo Fisher Scientific Inc.; Agilent Technologies, Inc.; Waters Corporation; PerkinElmer, Inc.; Fluid Management Systems (FMS); Sartorius AG; MACHEREY-NAGEL GmbH & Co. KG; Shimadzu Corporation; Biotage AB among others.

Market Breakdown: Types, Applications & Regions

By Type

SPE Cartridges remain the dominant format throughout the forecast period owing to their ease-of-use, reproducibility, and compatibility with high-throughput and automated systems. Their pre-packed format eliminates the need for handling loose sorbents, making them attractive for laboratories prioritizing consistency and operational efficiency.

Disks and plates also form part of the segmentation, but their adoption remains modest compared to cartridges.

By Application

The pharmaceutical & biotechnology sector holds the largest share (48.67% in 2023), underpinned by growing demand for rigorous quality control, impurity profiling, method development, and compliance testing in generics and novel therapeutics.

Other important applications include academic and research institutes, environmental laboratories (for contaminants, pollutants, water/soil/air testing), food and beverage analysis, clinical & forensic toxicology, and other industrial and chemical applications.

By Region

North America stands out as the most dominant region thanks to its well-established pharmaceutical industry, strict regulatory environment (FDA, EPA), advanced laboratory infrastructure, and high adoption of automated analytical workflows.

Asia-Pacific, Europe, Latin America, Middle East & Africa, and Eastern Europe are also covered in the report, with Asia-Pacific emerging as a potential growth hotspot as analytical testing, environmental monitoring, and pharmaceutical manufacturing expand in those regions.

Why SPE Matters and What’s Driving Growth?

SPE provides a robust, efficient, and sensitive method for isolating and concentrating target analytes from complex matrices whether biological fluids, environmental samples, or food and beverage extracts. This selectivity, combined with reduced solvent usage, higher throughput, and better reproducibility, makes SPE the method of choice over traditional liquid-liquid extraction in many lab workflows.

The rising production of generics worldwide driven by patent expirations and demand for cost-effective therapies has increased the need for stringent quality control, bio-equivalence testing, impurity profiling, and stability studies. SPE plays a critical role in supporting these efforts, driving sustained demand in the pharma & biotech sector.

Moreover, increasing environmental concerns, regulatory enforcement for water and soil pollutants, and heightened food safety standards have boosted SPE adoption in environmental and food testing laboratories.

Advancements in sorbent materials and automation (including automated SPE systems) are further enhancing throughput, minimizing human error, and enabling high-volume sample processing another key factor fueling market growth.

What’s Fueling the Opportunity and What’s Holding Back Growth?

Where’s the Opportunity?

- Growing demand from environmental monitoring, food safety labs, and forensics due to rising regulatory stringency globally.

- Expansion of academic and biotech research proteomics, metabolomics, genomics all requiring robust sample prep methods compatible with chromatography and mass spectrometry workflows.

- Automation and high-throughput SPE systems enabling labs to scale, reduce turnaround times, and improve reproducibility.

What Are the Challenges?

- Sample Matrix Interference: The effectiveness of SPE can be compromised by complex sample matrices (salts, proteins, lipids), which may interfere with sorbent binding or lead to poor recovery.

- Cost Pressures: Advanced SPE systems (especially automated platforms) and high-performance sorbents can be expensive a barrier especially for smaller labs or institutions in emerging markets.

- Need for Standardization: Given varying sample types (environmental, biological, food), optimizing SPE protocols for each matrix remains a challenge hindering universal adoption.

What’s New Recent Breakthroughs & Competitive Moves

- In October 2023, Waters Corporation introduced its “Extraction Connected Device”, a software-controlled solution for its Andrew+ automated pipetting robot marking a significant step toward full automation of SPE workflows for biological, environmental, food, and forensic samples.

- In December 2023, Fluid Management Systems (FMS) announced a co-marketing agreement with Agilent Technologies, Inc. to jointly market integrated workflows for testing persistent organic pollutants (POPs) including PFAS, dioxins, PCBs in environmental and food matrices. This underscores rising demand for SPE-based protocols in contamination monitoring and regulatory compliance.

These developments reflect a clear industry shift toward automation, integrated workflows, and expanded applications beyond traditional pharma labs strengthening the growth trajectory of the SPE market.

“Why Now?”: Key Market Trends A Closer Look 💡

- Regulatory Pressure & Environmental Awareness Stricter standards for pollutant monitoring, food safety, and water quality are pushing laboratories to adopt sensitive, reliable sample prep techniques like SPE.

- Expanding Generic Drug Production As more drugs go off-patent, generics manufacturers require robust analytical workflows for quality assurance, boosting SPE demand.

- Data Quality & Reproducibility Researchers in biotech, proteomics, metabolomics increasingly rely on SPE to ensure clean samples for downstream analysis (LC-MS, GC-MS), reinforcing SPE’s role in high-precision science.

- Automation & Throughput Laboratories handling large volumes (environmental testing labs, contract research orgs, CROs) are driving demand for automated SPE systems to save time, reduce error, and improve consistency.

Challenges to Watch What Could Hold Back Market Growth?

- Matrix Complexity: Some sample types (especially environmental or biological) include challenging components (salts, proteins, lipids) that can interfere with sorbent binding impacting recovery and reproducibility. This necessitates optimized protocols, which increases complexity and time.

- High Cost of Advanced Systems: Automated SPE systems and high-performance sorbent cartridges can be cost-prohibitive for smaller labs or in emerging markets potentially limiting adoption.

- Competition from Alternative Methods: For certain sample types or workflows, alternative extraction or purification methods may still compete with SPE especially where cost or simplicity is prioritized.

Example Use Case: SPE in Generics Drug Quality Control

At a mid-sized European generics manufacturer, adoption of SPE cartridges for impurity profiling enabled a reduction of solvent consumption by 30%, cut sample-prep time in half, and improved consistency across batches facilitating smoother regulatory submissions and faster time-to-market. Given rising global generic output, such operational efficiencies translate into significant cost savings and compliance benefits at scale.

Request Your Copy / Schedule a Consultation

To download a free sample https://introspectivemarketresearch.com/reports/solid-phase-extraction-spe-market/

Contact:

Introspective Market Research

Phone: +91-91753-37569

Email: sales@introspectivemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness