Artificial Intelligence (AI) Insurtech MarketSize and Growth Forecast: Emerging Trends & Analysis

AI insurtech refers to the convergence of artificial intelligence (AI) and insurance technology (insurtech), where AI-driven tools and platforms are used to modernize traditional insurance processes. This includes underwriting, claims processing, pricing, fraud detection, customer service (chatbots), risk assessment, and more. AI enables insurers to automate, analyze, and personalize in ways that were not possible with legacy systems.

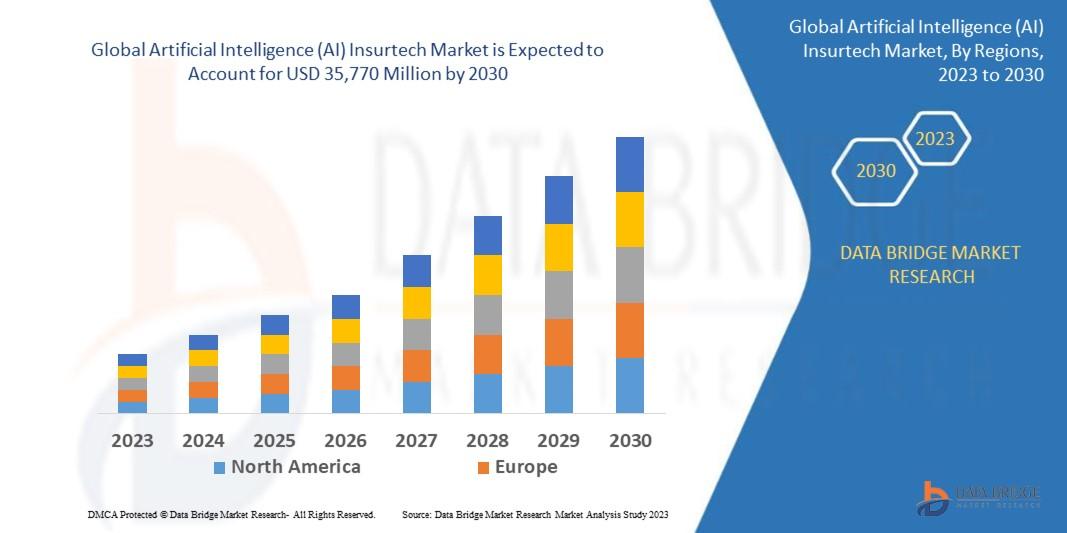

Data Bridge Market Research analyses that the global artificial intelligence (AI) insurtech market which was USD 3,640 million in 2022, is expected to reach USD 35,770 million by 2030, and is expected to undergo a CAGR of 33.06% during the forecast period of 2023 to 2030.

market Size & Growth Projections

-

According to Precedence Research, the global AI in insurance market was USD 8.13 billion in 2024 and is projected to surge to USD 141.44 billion by 2034, implying a very strong CAGR of ~33%. Precedence Research

-

Market Research Future (MRFR) estimates the AI insurtech market was USD 8.99 billion in 2024, projecting growth to USD 93.86 billion by 2035 at a CAGR of 23.77%. Market Research Future

-

According to WiseGuy Reports, slightly different numbers: the AI insurance market was USD 5.43 billion in 2024 and expected to reach USD 30 billion by 2035, growing at a CAGR of ~16.8%. WiseGuy Reports

-

Another WiseGuy Report puts the market at USD 4.4 billion in 2024, rising to USD 25 billion by 2035, with a projected CAGR of 17.1%. WiseGuy Reports

-

The Business Research Company projects growth from USD 7.71 billion in 2024 to USD 10.24 billion in 2025, with a CAGR of 32.8%, eventually reaching USD 35.62 billion by 2029. The Business Research Company

Despite variation in forecasts, all sources consistently show very high expected growth, underscoring how AI is rapidly reshaping the insurance industry.

Key Drivers & Trends

-

Automation & Efficiency Gains

-

AI helps automate labor-intensive tasks such as claims handling, underwriting, and policy administration, reducing manual workload and cost. GlobeNewswire+2Market Research Future+2

-

Predictive analytics and machine learning improve risk assessment, enabling more accurate pricing and underwriting. WiseGuy Reports+1

-

-

Fraud Detection

-

Fraud is a major cost for insurers, and AI systems (pattern recognition, anomaly detection) are increasingly used to spot and prevent fraudulent claims. Global Growth Insights+2Market Research Future+2

-

According to some reports, fraud detection remains one of the dominant use cases for AI in insurance. Market Research Future

-

-

Improved Customer Experience

-

AI-powered chatbots and virtual assistants are deployed to give real-time support, simplify customer interaction, and reduce response times. Global Growth Insights+1

-

Personalization: AI helps tailor policy recommendations and coverage based on individual customer data and behavior. Global Growth Insights+1

-

-

Underwriting Intelligence

-

AI-driven underwriting leverages big data and predictive models, enabling more nuanced risk evaluation and price optimization. Precedence Research

-

This allows for more flexible, usage-based, or dynamic insurance products.

-

-

Regulatory & Operational Risk Management

-

AI supports compliance, risk monitoring, and regulatory reporting by analyzing large volumes of data in real time. WiseGuy Reports

-

Insurers increasingly rely on AI to strengthen governance and reduce operational risk.

-

-

Investment & Insurtech Funding

-

Investment in insurtech is being driven by AI: for example, AI-focused insurtech firms are attracting substantial funding. Reuters

-

Startups leveraging AI are innovating fast, especially in underwriting, embedded insurance, and claims.

-

Challenges & Risks

-

High Implementation Cost: Deploying sophisticated AI systems (especially for large insurers) requires substantial investment in data infrastructure, talent, and integration. Global Growth Insights+1

-

Data Quality & Privacy: Insurance depends on high-quality, reliable data; AI models are only as good as their data. Also, customer data is sensitive, raising privacy and regulatory issues. Precedence Research+1

-

Model Risk & Explainability: AI models can be opaque (“black box”), making it hard for insurers to explain premium decisions or claims denials.

-

Adversarial Attacks: AI systems could be manipulated (e.g., adversarial inputs) to produce incorrect risk or claim assessments. arXiv

-

Trust & Consumer Acceptance: Customers may distrust fully automated decisions, especially in sensitive insurance contexts (health, life). arXiv

-

Regulatory Uncertainty: AI in insurance operates in a complex regulatory environment. As AI governance evolves (especially across regions), insurers must adapt to varying rules. arXiv

-

Fraud via Deepfakes: Emerging risk: generative AI (deepfakes) could be used to fabricate claims or manipulate evidence. Reuters

Regional Dynamics

-

North America: Leading region in adoption, driven by mature insurtech ecosystems, strong investments, and regulatory openness. Global Growth Insights+1

-

Asia-Pacific: Rapid growth expected, fueled by digital-first insurance models, mobile penetration, and rising AI adoption in emerging markets. Market Research Future

-

Europe: Significant potential, although somewhat constrained by stricter data/privacy regulation; but AI can help insurers comply and optimize. Precedence Research

-

Middle East & Africa, Latin America: Emerging, with potential in markets that are leapfrogging with digital insurance; but adoption may lag compared to developed markets. Verified Market Reports+1

Key Application Areas

-

Claims Processing

-

AI speeds up claims handling via automated decision-making, image analysis (for property damage), and predictive models to flag complex or high-risk claims. WiseGuy Reports+1

-

-

Underwriting & Risk Management

-

AI models assess risk more precisely, enabling dynamic pricing, usage-based insurance, and real-time risk adjustments. Precedence Research

-

-

Fraud Detection & Prevention

-

Pattern-detection algorithms help insurers detect suspicious behavior or anomalies in claims. Market Research Future+1

-

-

Customer Service & Engagement

-

Chatbots, virtual agents, and AI-based portals improve customer interaction and make policy management smoother. Global Growth Insights

-

-

Predictive Analytics & Risk Insights

-

Insurers use AI to predict loss events, assess future exposure, and understand customer behavior more deeply.

-

Competitive Landscape & Key Players

Some of the notable players operating in AI insurtech / AI-in-insurance include:

-

Lemonade – A digitally native insurer that uses AI for underwriting, claims, and customer interactions. Market Research Future

-

Shift Technology – Specializes in AI-driven fraud detection for insurance. Market Research Future

-

Tractable – Uses computer vision to assess damage (e.g., in auto claims). Market Research Future

-

Zego, Next Insurance – Insurtech firms innovating in usage-based insurance, embedded insurtech, and data-driven risk. Market Research Future

-

Tech & Platform Giants: Microsoft, Amazon Web Services (AWS), Salesforce, Cognizant are mentioned in AI insurtech market analyses as technology providers/partners. Global Growth Insights

-

Legacy Insurers & Consultancies: Traditional insurers are also investing heavily, often via partnerships, to modernize with AI. Precedence Research

Emerging Opportunities

-

Usage-Based and Telematics Insurance: AI can analyze driving behavior, sensor data, and usage to price policies more fairly.

-

Embedded Insurance: Insurers working with non-insurance platforms (e.g., mobility, e-commerce) can use AI to offer in-context, on-demand insurance.

-

AI for Cyber Insurance: As cyber risks grow, AI can help with dynamic risk modeling, continuous monitoring, and real-time underwriting.

-

RegTech & Compliance: AI to help insurers manage regulatory burden, automate reporting, and monitor for compliance risk.

-

Explainable AI: Development of AI models that are interpretable for regulatory and consumer trust.

-

Sustainable Insurance: AI can help price and underwrite “green” risk (e.g., environmental, climate) more accurately.

Strategic Implications for Insurers

-

Invest in Data Infrastructure: To scale AI, insurers must build robust data platforms, employ data scientists, and ensure data quality.

-

Partnerships Are Key: Collaborating with insurtech startups, AI vendors, and technology firms accelerates adoption.

-

Focus on Trust & Transparency: Explainable AI, ethical AI practices, and clear communication with customers will be crucial.

-

Balance Automation with Human Oversight: While AI is powerful, human judgment will continue to play a role, especially in complex decisioning.

-

Prepare for Regulatory Evolution: Insurers should proactively engage with regulators, build AI governance frameworks, and stay ahead of compliance risks.

Risks to Watch

-

Model Failures: Poorly trained models could lead to underwriting mistakes or unfair claim denials.

-

Adversarial Exploits: Malicious actors could try to trick AI systems (e.g., via adversarial inputs). arXiv

-

Consumer Backlash: If customers feel AI decisions are unfair, opaque, or violate their privacy, trust could erode.

-

Ethical Concerns: Bias in data or algorithms could lead to discriminatory pricing or exclusion of certain customer groups.

-

Deepfake Fraud: Generative AI might be misused in fraudulent claims (e.g., fake video or audio evidence). Reuters

-

Browse More Reports:

Global Burn Care Market

Global Lupine Seed Market

Global Wearable Soft Robotics Market

Global Virtual Reality (VR) Therapy for Mental Health Market

Global Navigation Satellite System (NSS) Chip Market

Global Carbon Nanotubes (CNT) Market

Global Massage Guns Market

Global Monoammonium Phosphate Market

Global Sensor Cleaning System Market

North America Utility Locator Market

Europe Stand-Up Paddleboard Market

Asia-Pacific Spouted Pouches Market

Europe Pipe Market

Egypt Physical Security Market

Europe Offsite Sterilisation Service Market

Outlook & Future Trajectory

-

Rapid Growth: Given the strong CAGRs projected (in many reports, 20–30%+), AI insurtech is likely to become a core part of the insurance value chain.

-

Maturing Use Cases: Early adoption (chatbots, fraud detection) will expand into more sophisticated AI (predictive risk, underwriting automation).

-

Regulation Will Shape Innovation: As AI governance frameworks evolve, regulations may both constrain and drive innovation.

-

Embedded & Personalized Insurance: AI will be central to creating highly personalized, usage-based insurance products.

-

Sustainable & Ethical AI: Growing focus on responsible AI will push insurers to adopt models that are transparent, fair, and explainable.

Conclusion

The global AI insurtech market stands at a transformative juncture. With exponential growth predicted over the next decade, AI is fundamentally reshaping how insurance companies underwrite risk, manage claims, detect fraud, and interact with customers. While the opportunities are vast—ranging from cost reduction to hyper-personalized insurance—insurers must navigate challenges around trust, regulation, and data responsibly.

For traditional insurers, the imperative is clear: adopt AI strategically, not just to digitize, but to truly transform. For insurtech startups, there is a massive runway to scale, especially in high-value, data-driven use cases. And for consumers, AI-enabled insurance promises more personalized, efficient, and potentially fairer coverage—if done right.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness