Electric Drive Mining Truck Market Opportunities Driven by Carbon Reduction Initiatives 2032

Electric Drive Mining Truck Market: Global Outlook, Trends & Forecast (2025–2032)

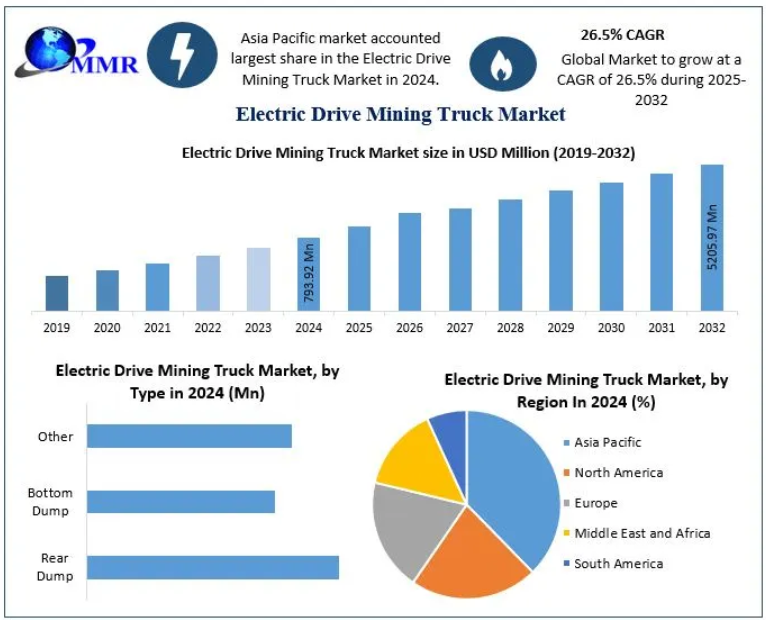

The Electric Drive Mining Truck Market, valued at USD 793.92 million in 2024, is on an accelerated growth trajectory. The market is projected to expand at a CAGR of 26.5% from 2025 to 2032, ultimately reaching USD 5,205.97 million. This remarkable rise is driven by the adoption of electrified heavy-duty vehicles, sustainability mandates, advancements in battery technology, and increasing investment in mining and infrastructure development worldwide.

Market Overview

Electric drive mining trucks are high-capacity automated vehicles used extensively in mining, quarrying, and construction sites. They are engineered for heavy load transportation in challenging terrains, offering reduced emissions, lower maintenance, enhanced efficiency, and improved performance in cold and high-altitude environments compared to diesel-based models.

Manufacturers are increasingly integrating electric drivelines, hydrogen fuel cells, and advanced lithium-ion batteries to meet the demand for cleaner mining operations. For instance, major collaborations—such as the Anglo-American, ENGIE, and Williams Advanced Engineering partnership—have led to the development of the world’s largest hydrogen-powered electric mining truck.

Growing electrification initiatives across North America, Europe, and Asia-Pacific further boost the adoption of next-generation mining trucks.

Access your free report sample — uncover the top-performing segments today:https://www.maximizemarketresearch.com/request-sample/183384/

Competitive Landscape

The market is moderately consolidated with strong global players and rising regional manufacturers. Companies competing on technology, reliability, fleet integration, and autonomous capabilities include:

Key Global Manufacturers

- Caterpillar Inc.

- Hitachi Ltd.

- Komatsu Ltd.

- Volvo

- BelAZ

- Terex Corporation

- XCMG Group

Regional & Emerging Players

- BEML Limited

- Epiroc Mining India

- Voltas Ltd.

- Kress Corporation

- Xiangtan Electric Manufacturing

These players focus on R&D investments, strategic partnerships, and electrified model launches. Examples include:

- Rio Tinto’s USD 2.9 million investment to enhance metal recovery for truck manufacturing.

- Ashok Leyland’s introduction of BS-VI compliant tippers.

- SML Isuzu’s release of new heavy-duty electric-ready carriers.

The growing trend of local production and cross-border collaborations continues to intensify competition.

Market Dynamics

1. Rising Adoption of Electric Autonomous Mining Trucks (E-AMTs)

Electric autonomous mining trucks have become a major technological breakthrough. These vehicles:

- Operate without human intervention

- Are equipped with GPS, wireless communication, and advanced detection systems

- Enhance operational safety by reducing collisions and equipment interference

Companies like Komatsu and Caterpillar have already deployed autonomous haulage systems (AHS) capable of managing fleets of 200–400 ton trucks. The integration of intelligence systems, predictive control mechanisms, and optimized braking technologies is driving rapid adoption.

2. Infrastructure Expansion Fueling Market Growth

Massive global investments in infrastructure—especially in India, China, and Southeast Asia—are increasing demand for heavy-duty electric mining trucks. Growth in road construction, urban development, waste management, transport infrastructure, and industrial complexes directly boosts the requirement for large-scale excavation and hauling solutions.

As construction projects become larger and more complex, the need for efficient, high-capacity electric dump trucks continues to rise.

3. Technological Advancements in EV Batteries

Advances such as:

- High-density lithium-ion cells

- Faster charging technologies

- Improved thermal management

- Dual hydrogen and battery power systems

are making electric trucks more viable, durable, and cost-effective for long mining routes.

4. Growing Sustainability Mandates

Governments worldwide are enforcing stricter emission standards for off-road vehicles. Mining companies are urged to transition toward zero-emission fleets to reduce carbon footprints and operational pollution.

Electric drive mining trucks offer:

- Zero tailpipe emissions

- Lower fuel and maintenance costs

- Reduced noise and improved worker safety

This makes them a preferred choice for environmentally compliant mining operations.

5. High Raw Material Costs – A Key Challenge

Despite its growth, the market faces hurdles due to rising costs of EV battery materials such as:

- Lithium

- Cobalt

- Nickel

Global supply chain disruptions and geopolitical tensions—including the war in Ukraine—have doubled the cost of EV battery raw materials. This directly impacts electric truck pricing and slows adoption among cost-sensitive mining firms.

Market Segmentation

By Type

- Rear Dump Trucks – Dominant segment due to high efficiency in transporting stones, ores, and waste.

- Bottom Dump Trucks

- Others

Rear dump trucks hold a majority share due to their versatility in mining and construction, lower operating cost, and increasing demand for rigid dump machinery.

By Size

- Small (90–150 Metric Tons)

- Medium (151–250 Metric Tons)

- Large (251–350 Metric Tons)

- Ultra (Above 351 Metric Tons)

Large and ultra-size categories are gaining traction as mining companies scale operations and open new mining sites globally.

Access your free report sample — uncover the top-performing segments today:https://www.maximizemarketresearch.com/request-sample/183384/

Regional Insights

1. Asia-Pacific – Market Leader

Asia-Pacific dominates the global market due to:

- Expanding mining activities in China, India, Australia, and Japan

- High coal consumption and production

- Strong government support for industrialization and infrastructure development

China’s relaxation of coal production rules and India’s rising demand for minerals further fuel regional growth.

2. North America

Growth driven by:

- Demand for sustainable mining practices

- Heavy investments in autonomous mining technologies

- Major players like Caterpillar and Komatsu operating large fleets of AHS trucks

3. Europe

Rapid adoption of zero-emission mining trucks aligned with EU climate targets. Countries like Sweden and Germany are testing hydrogen-electric hybrid mining vehicles.

4. Middle East & Africa

Substantial mining reserves, especially in South Africa and GCC countries, present expansion opportunities for electric heavy trucks.

5. South America

Mining-intensive regions like Brazil and Chile are increasingly electrifying their fleets, driven by sustainability-linked financing.

Key Players

- Terex Corporation

- Hitachi Ltd.

- OJSC BELAZ

- XCMG Group

- BEML Limited

- Caterpillar Inc.

- Komatsu Ltd.

- Kuhn Schweiz AG

- Voltas Ltd.

- Epiroc Mining India Limited

- Volvo

- BelAZ

- BEML

- Voltas

- Kress

- Xiangtan Electric Manufacturing

Conclusion

The Electric Drive Mining Truck Market is entering a transformative growth phase driven by automation, sustainability, infrastructure expansion, and technological advancements. While raw material costs present challenges, the push for greener mining operations is expected to sustain robust market growth through 2032.

The era of intelligent, autonomous, and eco-friendly mining trucks is reshaping the global mining industry—making operations safer, more efficient, and more environmentally responsible.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness