-

Fil d’actualités

- EXPLORER

-

Pages

-

Groupes

-

Evènements

-

Blogs

-

Offres

-

Emplois

-

Courses

Hybrid Truck Market: Role of Battery and Electric Assist Technologies 2032

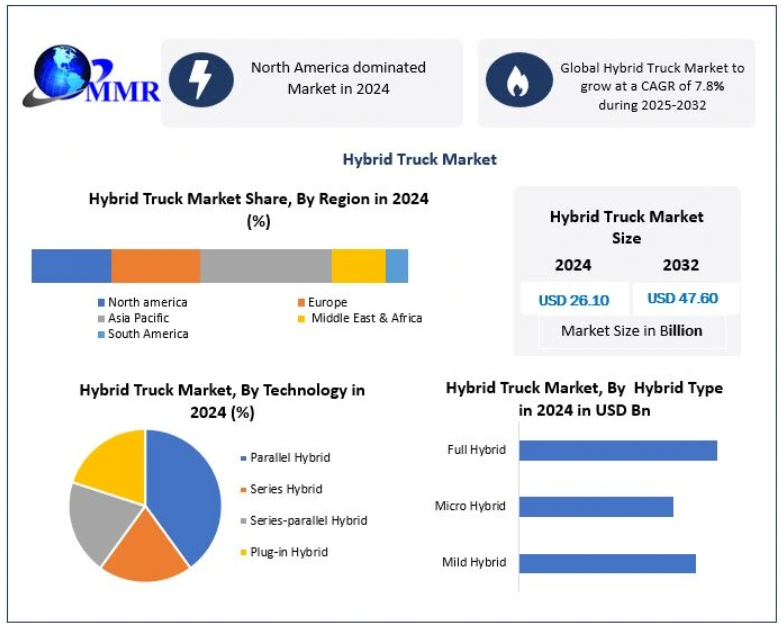

The Hybrid Truck Market was valued at USD 26.10 billion in 2024, and the total global revenue is projected to grow at a CAGR of 7.8% from 2025 to 2032, reaching USD 47.60 billion by 2032. The market is undergoing rapid transformation driven by tightening emission norms, fleet electrification, and advancements in hybrid powertrain technologies.

Market Overview

A hybrid truck integrates internal combustion engines with electric powertrains, offering improved fuel efficiency, reduced emissions, and better performance across urban and long-haul applications. Hybrid trucks span light-duty, medium-duty, and heavy-duty categories and employ parallel, series, plug-in, and series-parallel architectures.

In 2024, North America dominated the market, supported by strong regulatory frameworks, incentives, and an expanding infrastructure for plug-in and hybrid commercial vehicles. The Asia Pacific region is witnessing the fastest growth due to large-scale manufacturing, rapid fleet modernization, and government-backed clean mobility initiatives in China, Japan, and India.

Leading players such as Volvo Group, BYD Auto, and Ford Motor Company are pioneering innovations in hybrid systems, battery technology, and integrated powertrain management. Growing urban freight, sustainability targets, and rising fuel prices continue to accelerate hybrid truck adoption worldwide.

Find out where the real opportunities lie! Get your free report sample today by clicking here:https://www.maximizemarketresearch.com/request-sample/77705/

Hybrid Truck Market Dynamics

1. Rising Emission Norms Accelerating Hybrid Truck Deployment

Global policymakers are strengthening emission regulations to combat air pollution and decarbonize transportation. Key examples include:

-

CAFE standards in the U.S.

-

EU CO₂ emission targets

-

Large-scale fleet electrification mandates across North America, Europe, and Asia

Hybrid trucks significantly reduce greenhouse gas emissions compared to traditional diesel vehicles, making them a preferred choice for logistics companies and municipal fleets.

Electrification of medium and heavy-duty vehicles (MHDVs) has also gained momentum due to improvements in battery technologies and declining battery costs. Buses and urban delivery trucks lead the adoption curve, with China and Europe dominating battery-electric bus volumes.

2. Challenges: BEVs and FCEVs Increasingly Competitive

The hybrid truck market faces competition from:

-

Battery Electric Vehicles (BEVs)

-

Fuel Cell Electric Vehicles (FCEVs)

BEVs offer zero-tailpipe emissions, while FCEVs provide long driving ranges and fast refueling. Major global OEMs—such as Tesla, BYD, Volkswagen, and Hyundai—are investing heavily in BEV and hydrogen fuel cell technologies.

Government-backed hydrogen mobility programs, especially in Japan, Korea, Germany, and the U.S., may slow hybrid truck penetration in some segments (particularly heavy-duty).

Hybrid Truck Market Segmentation

By Powertrain Technology

-

Parallel Hybrid (largest segment)

Driven by widespread use of regenerative braking and lower cost compared to plug-in systems. -

Series Hybrid

-

Series-Parallel Hybrid

-

Plug-in Hybrid (PHEV)

Gains traction in light and medium-duty fleets needing short-range electrification.

By Hybrid Type

-

Full Hybrid

-

Micro Hybrid

-

Mild Hybrid

By Vehicle Type

1. Light-Duty Trucks (Dominant Segment)

Used in urban logistics, e-commerce delivery, and municipal services.

2. Medium-Duty Trucks

Ideal for regional distribution, waste management, and commercial fleets.

3. Heavy-Duty Trucks

Slower adoption due to high power needs and long-haul usage, but expected to rise with powertrain advancements.

Find out where the real opportunities lie! Get your free report sample today by clicking here:https://www.maximizemarketresearch.com/request-sample/77705/

Regional Analysis

North America – Market Leader (2024)

-

Strong regulatory push (EPA, CARB standards)

-

Incentives for fleet electrification

-

High concentration of OEMs (Ford, GM, PACCAR)

Asia Pacific – Fastest Growing Region

-

China, Japan, India expanding hybrid truck production

-

Vertically integrated battery and powertrain supply chains

-

BYD, Tata Motors, Hino, and Isuzu fueling growth

Europe – Strong Sustainability Agenda

-

Strict climate targets driving adoption

-

Germany, France, Sweden leading heavy-duty hybrid programs

-

High investments from Daimler, Volvo, and Scania

Competitive Landscape

The hybrid truck market is dominated by strategically positioned global manufacturers:

Top Companies

-

Volvo Group (Sweden) – Leader in medium & heavy-duty hybrid systems

-

BYD Auto (China) – Strong in plug-in hybrid pickups and battery innovation

-

Ford Motor Company (USA) – Market leader in light-duty hybrid trucks (e.g., F-150 PowerBoost)

Other important players include GM, PACCAR, Daimler Truck AG, Tata Motors, Toyota, Mitsubishi Fuso, Hyundai, and Dongfeng Motor Corporation.

Leadership depends on:

-

Vertical integration of battery systems

-

Compliance with regional emission norms

-

Ability to scale across light, medium, and heavy-duty segments

Key Market Trends

| Trend | Details |

|---|---|

| Advanced hybrid architectures | Integration of LFP batteries, range-extenders, and multi-mode hybrid layouts to boost efficiency. |

| Regenerative braking & energy management | Trucks now feature AI-based telematics, connected systems, and improved energy recovery. |

| Fleet electrification | Companies adopt hybrids as a cost-effective transition before full EVs. |

| Vehicle-as-a-power-source | Hybrid trucks increasingly offer onboard auxiliary power for tools and emergency operations. |

Key Developments

-

May 2025 – Geely launched Radar Horizon EM P plug-in hybrid pickup in China.

-

January 2025 – Toyota’s Hino Motors and Daimler’s Mitsubishi Fuso merged to accelerate clean-energy truck development.

-

December 2024 – Stellantis fast-tracked the Ramcharger hybrid due to slower EV uptake.

-

October 2024 – Bharat Forge acquired American Axle & Manufacturing to strengthen hybrid drivetrain capabilities.

-

May 2024 – BYD debuted the Shark plug-in hybrid pickup in Mexico, expanding to Australia and Brazil.

Hybrid Truck Market Scope

-

Base Year: 2024

-

Forecast: 2025–2032

-

Market Size (2024): USD 26.10 Bn

-

Market Size (2032): USD 47.60 Bn

-

Segments: Technology, Hybrid Type, Vehicle Type, Powertrain Type

-

Regions Covered: North America, Europe, APAC, Middle East & Africa, South America

Key Players by Region

North America

Ford, GM, PACCAR, Workhorse Group, XL Fleet, Nikola

Europe

Volvo, Daimler, Iveco, MAN, Renault Trucks, Scania, DAF

Asia Pacific

BYD, Tata Motors, Ashok Leyland, Hino, Isuzu, Toyota, Dongfeng, FAW, Hyundai

Middle East & Africa

Ashok Leyland UAE, Shacman, Laraki

South America

Volkswagen Brazil, Agrale, Mercedes-Benz do Brazil, Volvo do Brasil

Conclusion

The hybrid truck market is positioned for robust growth through 2032, driven by stricter emission norms, urban logistics expansion, and continuous advancements in hybrid powertrain technology. While competition from BEVs and FCEVs intensifies, hybrid trucks remain a critical transitional technology for fleets seeking cost-effective, sustainable, and high-performance solutions. Companies that innovate in battery ecosystems, powertrain integration, and region-specific offerings will dominate the next phase of the market.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness