Payment Security Market Dynamics: AI and Encryption Technologies Transforming the Industry 2032

Global Payment Security Market: Empowering Safe Digital Transactions Worldwide

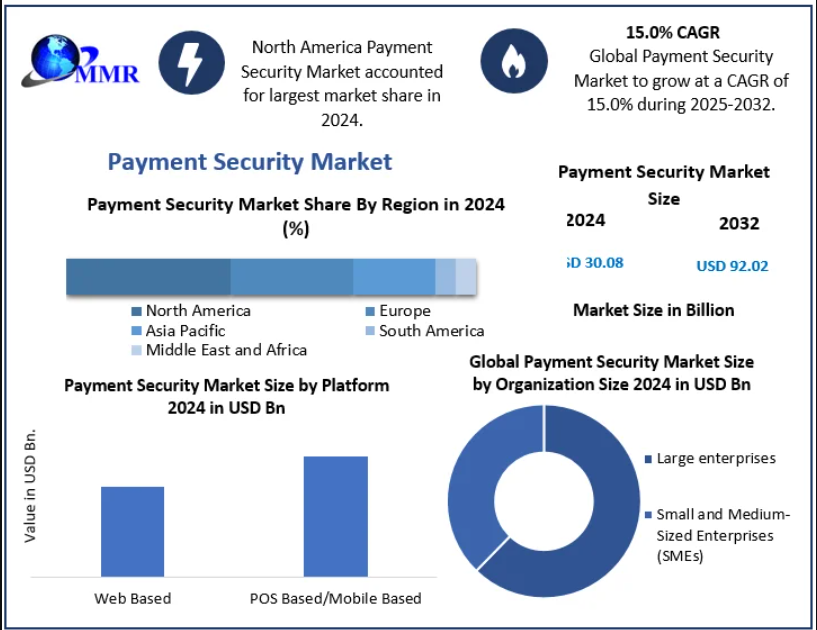

The Global Payment Security Market was valued at USD 30.08 billion in 2024 and is projected to grow at a CAGR of 15.0% from 2025 to 2032, reaching approximately USD 92.02 billion by 2032. This strong growth reflects the surge in digital payment adoption and the increasing need to safeguard financial data against evolving cyber threats.

Payment Security Market Overview

Payment security refers to the technological measures and protocols used by merchants and financial institutions to ensure safe, fraud-free digital transactions. As e-commerce, online banking, and contactless payments continue to rise globally, the need for robust payment security systems has become indispensable. These systems prevent risks such as data breaches, identity theft, and financial fraud by using encryption, tokenization, and authentication mechanisms.

The accelerating digital transformation of industries, growing consumer preference for cashless payments, and government initiatives to enhance financial transparency are key forces shaping this market.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/24755/

Payment Security Market Dynamics

Drivers

-

Rising Data Breaches and Cyber Threats:

With data breaches becoming increasingly sophisticated, organizations are investing heavily in advanced fraud detection and encryption technologies to protect sensitive financial data. -

Compliance with Regulatory Standards:

The global enforcement of Payment Card Industry Data Security Standard (PCI DSS) and other compliance frameworks has propelled enterprises to adopt secure payment systems. -

Expansion of Mobile and Contactless Payments:

The growth of mobile wallets, QR-based transactions, and NFC technology has expanded the need for secure mobile-based payment platforms. -

Government Push Toward Cashless Economies:

Initiatives such as India’s Unified Payments Interface (UPI) and Europe’s PSD2 regulations have fueled secure digital payment adoption.

Restraints

-

High costs of implementation and integration of security solutions.

-

Lack of cybersecurity awareness among SMEs and consumers.

-

Resistance to adopting digital payment systems in emerging economies.

Opportunities

-

AI and machine learning–driven fraud detection systems are enabling predictive threat management.

-

Cloud-based payment security solutions are gaining traction due to scalability and cost efficiency.

-

Growing fintech innovations and digital banking ecosystems will open new market avenues.

Payment Security Market Segment Analysis

By Component

-

Solutions: Encryption, Tokenization, and Fraud Detection & Prevention dominate the market as organizations seek comprehensive, scalable protection systems.

-

Services: Integration, consulting, and support services are expanding as businesses need expert assistance for deployment and compliance management.

By Platform

-

POS-Based/Mobile-Based: Holds the largest market share due to widespread use of smartphones and contactless payment systems. Integration of biometric authentication and tokenized transactions enhances security at physical and digital points of sale.

-

Web-Based: Continues to grow steadily with e-commerce expansion and online payment gateways.

By Organization Size

-

Large Enterprises: Lead the market due to higher transaction volumes, larger customer databases, and increased regulatory scrutiny.

-

SMEs: Rapid adoption of cloud-based and cost-effective security solutions is fueling growth in this segment.

By End-User Industry

-

Retail & E-Commerce: Dominates the market as online shopping accelerates worldwide. Retailers are adopting AI-based fraud prevention systems and PCI DSS compliance tools.

-

BFSI: Continues to be a major segment owing to the high volume of sensitive transactions and stringent security mandates.

-

Healthcare, Telecom & IT, Education, and Hospitality: These sectors are witnessing rising adoption due to digitalization of services and increasing payment gateway usage.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/24755/

Regional Insights

North America:

Holds the largest market share, driven by major players such as Visa Inc., Mastercard, Shift4, and PayPal, along with the region’s mature digital payment infrastructure. Advanced adoption of contactless and omnichannel payment solutions contributes significantly to market dominance.

Asia Pacific:

Expected to witness the fastest growth during the forecast period. The region’s robust digital transformation initiatives, such as UPI in India and e-CNY in China, have accelerated secure payment technology adoption. Rapid fintech expansion, smartphone penetration, and government-led financial inclusion programs further bolster market growth.

Europe:

Demonstrates steady growth due to increasing adoption of PSD2-compliant payment solutions and contactless transactions. Retail digitization and growing awareness about online fraud prevention are supporting market expansion.

Middle East & Africa and South America:

These regions are emerging markets for payment security, driven by rising mobile banking usage and growing regulatory focus on secure financial systems. The increasing adoption of e-commerce platforms and mobile wallets presents lucrative growth potential.

Competitive Landscape

The payment security market is highly competitive, characterized by technological innovation, mergers, and partnerships among key players. Leading companies are focusing on enhancing encryption algorithms, AI-driven fraud detection, and integrated multi-channel solutions.

Key Players Include:

-

Shift4 Corporation

-

Thales

-

Bluefin Payment Systems LLC

-

Outseer

-

Elavon

-

OneSpan Inc.

-

UL Solutions

-

Broadcom Inc.

-

Verifone Systems, Inc.

-

MagTek Inc.

-

Worldpay LLC

-

Ingenico Group

-

FICO Enterprise

-

PayPal

-

CyberSource Corporation

-

PayU Global

-

TNS, Inc.

-

Utimaco Management GmbH

-

Mastercard

-

Fiserv Inc.

Conclusion

The Global Payment Security Market is at the forefront of enabling safe and frictionless financial transactions in an increasingly digital economy. As cyber threats evolve, the integration of AI, blockchain, and cloud security will redefine the future of payment protection. With rising consumer expectations for secure, seamless, and instant transactions, the market is poised for sustained innovation and exponential growth through 2032.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness