-

Новости

- ИССЛЕДОВАТЬ

-

Страницы

-

Группы

-

Мероприятия

-

Статьи пользователей

-

Offers

-

Jobs

-

Courses

Dry Butter Market Size to Reach [Estimated Value] by 2029 | CAGR: 3.8%

Market Estimation & Definition

Dry Butter Market , also known in certain contexts as Beurre de Tourage Butter, is a high‐fat butter with much of its moisture removed, designed to yield consistency in bakery and confectionery applications. It is particularly valued in laminated doughs (croissants, pastries), baguettes, and surface dough compositions owing to its fat content, flavor, and ability to deliver flakiness and richness. While its usage is most pronounced in the food & beverage industry—especially bakery and pastry production—it also finds application in household/retail settings and in “other” uses. There are two main types (salted and unsalted), and multiple applications of dry butter across geographies.

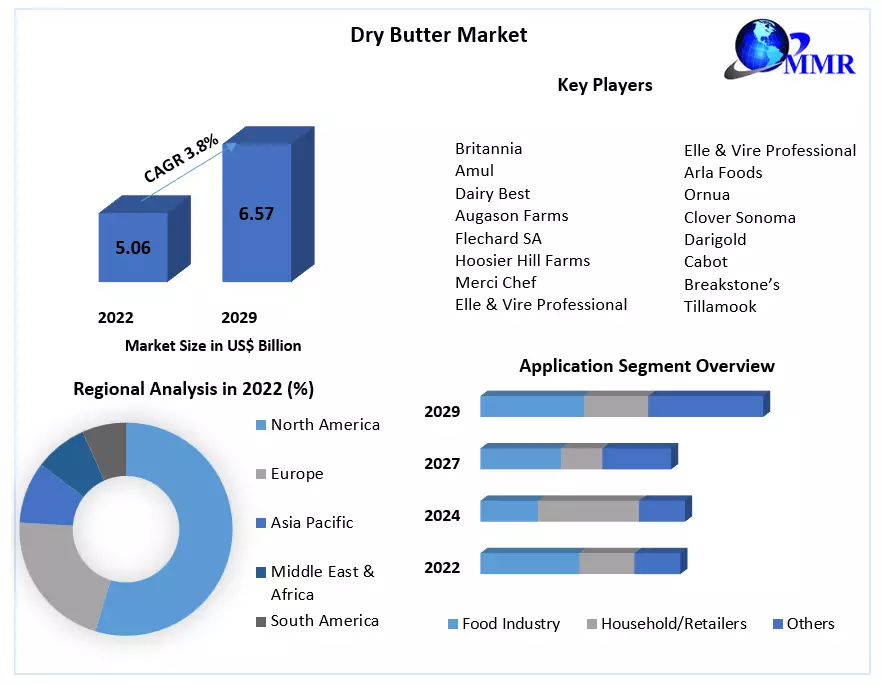

As per recent market research, the global dry butter market was valued at around US$ 5.06 billion in 2022. With a forecast CAGR of 3.8% from 2023 to 2029, this market is projected to reach approximately US$ 6.57 billion by 2029.

Gain Valuable Insights – Request Your Complimentary Sample Now @ https://www.maximizemarketresearch.com/request-sample/110728/

Market Growth Drivers & Opportunities

Several factors are fueling growth in the dry butter market:

-

Rising demand from bakery, confectionery and foodservice industries: The popularity of baked goods, pastries, croissants and other layered or laminated dough items continues to rise globally. Dry butter offers desirable properties in terms of fat content and structure for these applications.

-

Health consciousness & preference for natural ingredients: Consumers in many markets are increasingly discerning about additives, preservatives, and the nature of fats in their diet. Dry butter, particularly unsalted and lower‐salt variants, can be positioned as a more “natural” ingredient compared to heavily processed fats.

-

Convenience & shelf stability: Dry butter tends to have better shelf life and is more stable in transportation and storage compared to fully moisture‐rich fresh butter. This is particularly useful for industrial and food processing uses.

-

Technological improvements & innovation: Advances in drying technologies and processes, flavor variants, and product formulations (including lower‐salt, unsalted, etc.) present opportunities. Also, there is room for innovation in packaging, logistics, and supply chain to reduce costs and enhance quality.

-

Emerging markets & increasing per capita income: Regions such as Asia Pacific are expected to see strong growth due to increasing population, rising incomes, urbanization, and shifting diets toward more processed bakery and confectionery items.

Challenges or restraints include fluctuation in butter fat / raw material prices, supply disruptions (e.g. dairy supply), competition from substitutes (like margarine, plant based fats), consumer concerns over saturated fat or cholesterol, and regulatory pressures related to food safety, labeling and health.

Feel free to request a complimentary sample copy or view a summary of the report: https://www.maximizemarketresearch.com/request-sample/110728/

Segmentation Analysis

The market is segmented by type, application, and region. Below is a descriptive analysis of those segments:

By Type

-

Unsalted Dry Butter: This is the dominant type in the market. Unsalted dry butter is preferred in many food processing applications and by consumers who wish to control sodium content or customize flavor. It offers cleaner taste profiles, especially in baked goods and pastries where the salt level may be controlled separately.

-

Salted Dry Butter: Though less dominant in terms of market share, salted variants still hold importance for specific consumer preferences and applications. Salt acts both as flavor enhancer and mild preservative, though its presence sometimes limits flexibility in food formulation or customization.

By Application

-

Food Industry (Industrial / Commercial Use): This segment is expected to dominate during the forecast period. It includes large‐scale bakeries, confectionery manufacturers, pastry shops, and other food processors using dry butter as an ingredient in baked goods, fillings, laminated doughs, and so forth.

-

Household/Retail: This includes smaller scale or household usage, retail packaged dry butter, for direct consumer purchase. The growth here is tied to consumer awareness, packaging, taste, convenience, and willingness to pay for premium or specialty products.

-

Others: This may include uses outside direct food production and household consumption—such as possibly food service operations, “other” industrial uses, or niche applications.

By Region

-

Regions such as Asia‐Pacific are expected to be the fastest‐growing and to dominate the market in upcoming years, primarily due to large consumer bases, rising disposable incomes, greater demand for bakery and confectionery products, and expansion of food & beverage infrastructures.

-

Europe also holds strong position, particularly in countries historically associated with high butter / pastry consumption and where culinary traditions favor butter’s flavor and texture.

-

North America is another major region, supported by established food processing industries, consumer demand for convenience, premium ingredients, and bakery etc.

Dive deeper into the market dynamics and future outlook: https://www.maximizemarketresearch.com/request-sample/110728/

Country‐Level Analysis: USA and Germany

To understand how these trends play out locally, here is a closer look at the United States and Germany.

United States

In the USA, the broader butter market (including fresh butter, salted/unsalted etc.) has seen steady growth. While specific data for dry butter in the USA is less ubiquitous, indicators point to rising demand for butter products overall—especially in foodservice, bakery, artisan baking, and retail sectors. For example, reports show that the U.S. butter market generated revenues in the multiple‐billion USD range in recent years and continues to trend upward. Consumer preference shifts toward unprocessed, natural fats, and away from highly processed spreads, contribute to favorable market conditions.

Imperatives that affect the USA dry butter market include: relatively high purchasing power; sophisticated food processing infrastructure; demand for quality and innovation; regulatory oversight (health, labeling); and sensitivity to raw material supply (milk/dairy). On the opportunity side, USA manufacturers and importers can capitalize on the trend of clean label, premium ingredients, and growth of artisan baking. On the risk side, volatility in dairy farm output, feed costs (~milk supply), and competition from cheaper substitutes or margarine/plant‐based butter analogues are relevant constraints.

Germany

Germany represents a mature European market with strong tradition in bakery, pastry, confectionery, and premium food ingredients. Butter prices have been volatile; recent reports indicate that in Germany, butter producer prices spiked sharply at certain points, and bakery & butter product prices rose significantly. For example, producer prices for butter saw month‐to‐month jumps of 30‐40% in certain months, reflecting supply constraints or input cost pressures.

Consumer preferences in Germany are leaning toward quality, traditionally produced dairy products, high standards and transparency. Thus, dry butter (especially high quality, unsalted, or artisan variants) can find a robust market. However, Germany is also sensitive to pricing, cost pressures, and regulations (including EU dairy regulations, labeling, fat content, etc.). Domestic dairy production constraints, environmental regulations, and feed/pricing cost volatility are risk factors.

In both USA and Germany, inflation, cost of inputs (milk, feed, energy), and supply chain disruptions (including transportation, cold chain where relevant) will affect availability and pricing. The demand from bakeries and foodservice is likely to continue to grow, particularly where consumers eat baked goods, pastries, etc., as part of daily or regular consumption.

Competitor Analysis

Key players in the dry butter market globally include both large dairy‐ingredient companies and those specialized in premium butter / dairy products. Some of the major competitors are:

-

Amul

-

Ornua

-

Merci Chef

-

Flechard SA

-

Elle & Vire Professional

-

Arla Foods

-

Clover Sonoma

-

Darigold

-

Cabot

-

Breakstone’s

-

Tillamook

-

Britannia

-

Pucchu Milk Foods Pvt Ltd.

-

Dairy Best

-

Augason Farms

These companies differ in their strengths: product portfolio (salted vs unsalted, premium vs standard), regional presence, ability to innovate (flavored, specialty dry butter), cost efficiencies, supply chain robustness, branding, and quality control. For example, companies such as Elle & Vire and Arla are likely to focus more on premium and artisan segments; others like Amul or Britannia might leverage large scale, wide distribution in emerging markets.

Key strategic moves among competitors include developing low‐calorie or low‐salt dry butter variants, improving shelf stability, ensuring clean label or organic credentials, and expanding into high‐growth regions (Asia Pacific, etc.). Some are investing in improved drying technologies and in R&D to maintain or improve flavor and performance in baked goods.

Market Opportunities & Challenges (Commutator / Competitive Landscape Analysis)

In the competitive landscape (sometimes referred to as “commutator analysis”—i.e. who is competing, how, where), several themes emerge:

-

Differentiation through quality and product type: Unsalted vs salted, premium vs standard, flavored, organic, etc. Firms that can offer high quality with good consistency for bakery / pastry use will have an edge.

-

Scale vs niche: Large players with scale can optimize cost and distribution; smaller/premium players can focus on specialty, organic, artisan segments.

-

Cost pressures & input volatility: Producers are vulnerable to fluctuations in milk price, feed cost, energy cost, transportation. Those with integrated supply chains or stable sourcing (vertical integration, contracts with dairy farms) can mitigate risks.

-

Regulatory environment: Especially in Europe (Germany etc.), food safety, labeling (fat content, salt, nutrition), environmental standards, animal welfare are increasingly important. These can raise cost but also provide advantage to those who meet the high standards.

-

Substitutes and consumer trends: Plant-based butter alternatives, margarine, and various fat‐based substitutes represent competition. Also, dietary trends (low‐fat, low‐saturated fat, cholesterol concerns) may restrain demand in some consumer groups.

-

Distribution channels: Retail, foodservice, industrial buyers each have different requirements. E‐commerce and online retail are playing larger roles; companies able to adapt packaging, shelf stability, and logistics accordingly may capture more market share.

-

Innovation in product offerings: Lower salt, different flavor profiles, organic / grass‐fed dairy sources, clean label, etc., are all opportunities for competitive differentiation.

Conclusion

In conclusion, the global dry butter market is expected to undergo solid growth between 2023 and 2029, increasing from ~US$ 5.06 billion in 2022 to about US$ 6.57 billion by 2029, at a CAGR of ~3.8%. Growth will be propelled by the bakery/confectionery/food processing sectors, rising demand for premium and clean label dairy ingredients, and increasing health awareness among consumers. The market’s segmentation by type and application shows unsalted dry butter and food industry applications dominating, though salted variants and household/retail segments will also contribute meaningful growth particularly in certain geographies.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness