India Automotive Aftermarket Dynamics: Impact of EVs, ADAS, and Connected Cars 2030

India Automotive Aftermarket Market Size, Trends, Growth Drivers, and Forecast (2024–2030)

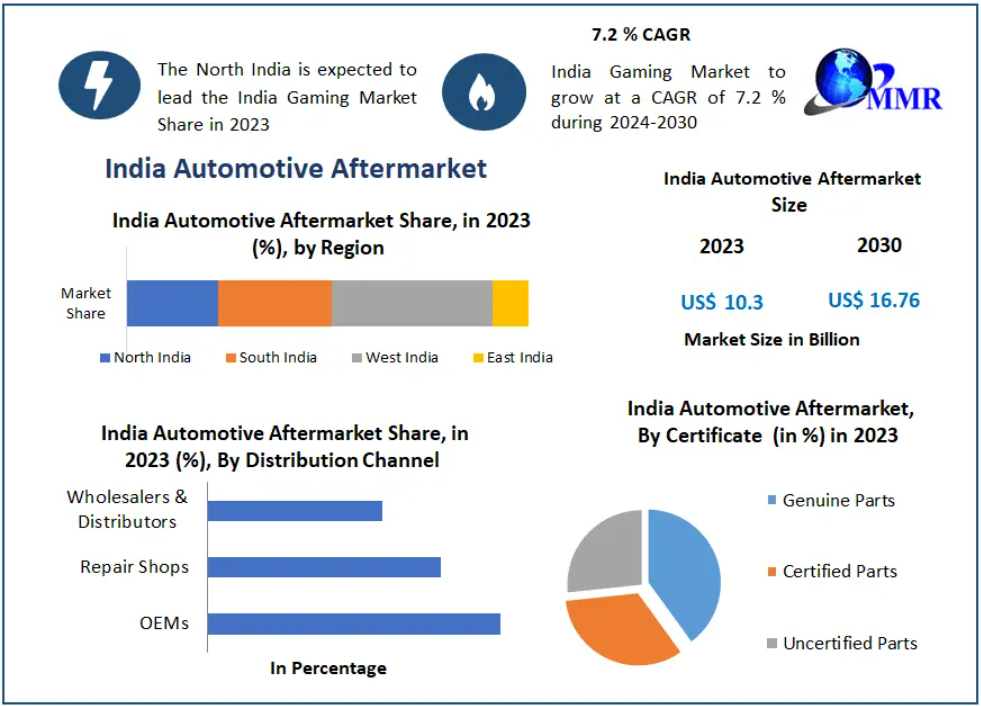

The India Automotive Aftermarket was valued at USD 10.3 billion in 2023 and is expected to expand to USD 16.76 billion by 2030, growing at a CAGR of 7.2%. Supported by one of the world’s largest and fastest-growing vehicle populations, expanding pre-owned vehicle sales, and rising technological adoption, the Indian aftermarket is evolving from a fragmented traditional ecosystem to a digitally enabled, opportunity-rich market.

Market Overview

India’s automotive aftermarket is on a strong upward trajectory as the country’s vehicle parc reaches 340 million units. Over the next five years, this figure is projected to rise at a CAGR of over 8%, creating massive demand for replacement parts, accessories, repair services, and maintenance solutions.

Growth is particularly robust in:

- Two-wheelers: expected to grow from 257 to 365 million units

- Passenger vehicles: projected to expand from ~47 million to over 72 million units

These segments form the backbone of India’s replacement parts demand.

The booming pre-owned car market, expected to grow at ~17.5% CAGR through FY2030, is accelerating aftermarket sales. Organized players and digital marketplaces are improving transparency and trust, pushing more consumers toward long-term maintenance spending.

Internationally, India is emerging as a key exporter of aftermarket components, with strong demand from markets such as:

- Indonesia

- LATAM

- Poland, Brazil, Colombia

- Bangladesh

- North, East, West & South Africa

- UAE

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/29939/

Key Trends Reshaping the India Automotive Aftermarket

- New Business Models: OEM + E-Commerce Integration

The aftermarket landscape is shifting from traditional sequential retail channels to direct distribution via online platforms.

OEM partnerships with e-commerce giants are increasing product accessibility, transparency, and pricing consistency.

A notable example:

- Bosch and TMall partnership generated USD 290 million GMV in 2015–16, showcasing the potential of digital channels.

- Shift in Revenue Sources

Traditional wear-and-tear parts are seeing slower growth due to improved component durability and better road infrastructure. Meanwhile:

- Crash-related parts demand is decreasing due to enhanced safety features in new vehicles.

- Diagnostics, predictive maintenance, and data-driven services are becoming major revenue generators.

Connected vehicles and IoT-based sensors now enable:

- Predictive failure alerts

- Remote vehicle diagnostics

- Customized service packages

- Rise of Predictive and Digitized Services

Digitization is enabling a transformation from reactive to proactive aftermarket maintenance. Workshops and OEM service centers are increasingly using:

- OBD-based diagnostics

- Cloud analytics

- App-based service scheduling

Market Drivers

Increasing Vehicle Sales Propelling Aftermarket Demand

India recorded a 15% year-on-year growth in vehicle sales in January 2024:

- Two-wheelers: 15% growth to 14,58,849 units

- Three-wheelers: 37% growth

- Passenger vehicles: 13% growth, reaching a record 3,93,250 units

- Tractors: 21% increase

- Commercial vehicles: growth remained stable at around 89,000 units

This surge is backed by:

- Strong rural demand

- Favorable agricultural conditions

- New model launches

- Supportive Union Budget initiatives

The result: larger vehicle parc = continuous aftermarket demand for replacement parts, servicing, and accessories.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/29939/

Market Restraints

Strict Regulatory Environment

Regulations around safety, emissions, and quality standards present significant challenges. Requirements include:

- BIS & AIS certifications

- Compliance with safety and emission norms

- Complex documentation and frequent policy changes

Key challenges include:

|

Challenge |

Description |

|

High compliance costs |

R&D, testing, and certification expenses |

|

Red tape & complexity |

Time-consuming regulatory navigation |

|

Barriers to entry |

Limits new entrants & innovation |

|

Innovation slowdown |

Companies focus on compliance over R&D |

|

Market fragmentation |

Favors larger, established players |

|

Consumer perception |

Quality-linked compliance impacts brand trust |

|

Trade barriers |

Export complications due to unique Indian norms |

A balanced regulatory framework is essential to support innovation while ensuring safety.

Market Opportunities

- Technological Advancements Creating New Revenue Streams

Innovations such as EVs, connected vehicles, ADAS, and 3D printing are reshaping aftermarket possibilities.

Opportunities include:

- EV charging stations, retrofitting kits & battery management systems

- ADAS calibration services

- Remote diagnostics

- Predictive maintenance & fleet management

- Custom components via 3D printing

As India transitions to electric and smart mobility, aftermarket players will benefit from offering specialized services and components.

Segment Analysis

By Replacement Parts

Tires dominated the market in 2023, driven by:

- High wear-and-tear rate

- India’s increasing vehicle ownership

- Strong demand from two-wheelers and passenger vehicles

- Competitive tire manufacturing ecosystem

Indian tire companies are investing in smart tires, EV-compatible tires, and wide distribution networks, boosting segment growth.

Other Key Segments

- Batteries

- Brake parts

- Filters

- Lighting & electronics

- Turbochargers

- Body parts

- Exhaust components

- Wheels & accessories

Regional Insights

- Northern Region – Market Leader (2023)

Delhi NCR, Uttar Pradesh, Punjab, and Haryana lead due to:

- Highest vehicle density

- Strong demand from both urban and rural markets

- Large volume of passenger vehicles, CVs, and agricultural machinery

- Western Region

Maharashtra, Gujarat, and Rajasthan drive growth through:

- Automotive clusters (Pune, Sanand)

- Strong aftermarket demand in commercial vehicle & industrial hubs

- Southern Region

Known for:

- OEM manufacturing hubs

- Rising two-wheeler demand

- Tech-enabled service networks

- Eastern Region

An emerging market with rising urbanization and improving distribution networks.

Market Segmentation Overview

By Certification

- Genuine Parts

- Certified Parts

- Uncertified Parts

By Service Channel

- DIY

- DIFM

- OE Service

By Distribution Channel

- OEMs

- Repair Shops

- Wholesalers & Distributors

Key Players in the India Automotive Aftermarket

- Bosch India

- TVS Group

- Mahindra & Mahindra

- Exide Industries

- Tata Motors

- Minda Industries

- Amara Raja Batteries

- Ashok Leyland

- Hero MotoCorp

- Maruti Suzuki

- Motherson Sumi Systems

- JK Tyre & Industries

- Lumax Industries

- Sundram Fasteners

- WABCO India

- Gabriel India

- CEAT Ltd.

- SKF India

- MRF Limited

- Apollo Tyres

These companies are focusing on digitization, expanding distribution channels, and building strong aftermarket service networks to gain market share.

Conclusion

The India Automotive Aftermarket is entering a dynamic growth phase driven by:

- Rising vehicle population

- Growth in pre-owned vehicles

- Adoption of digital service models

- Technological innovations in EVs & connected vehicles

As the automotive ecosystem becomes more tech-driven and customer-centric, aftermarket players that embrace innovation, regulatory compliance, and digital distribution will lead the market through 2030.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness