-

Новости

- ИССЛЕДОВАТЬ

-

Страницы

-

Группы

-

Мероприятия

-

Статьи пользователей

-

Offers

-

Jobs

-

Courses

Thermal Screening Market Analysis: Technology Adoption and Growth

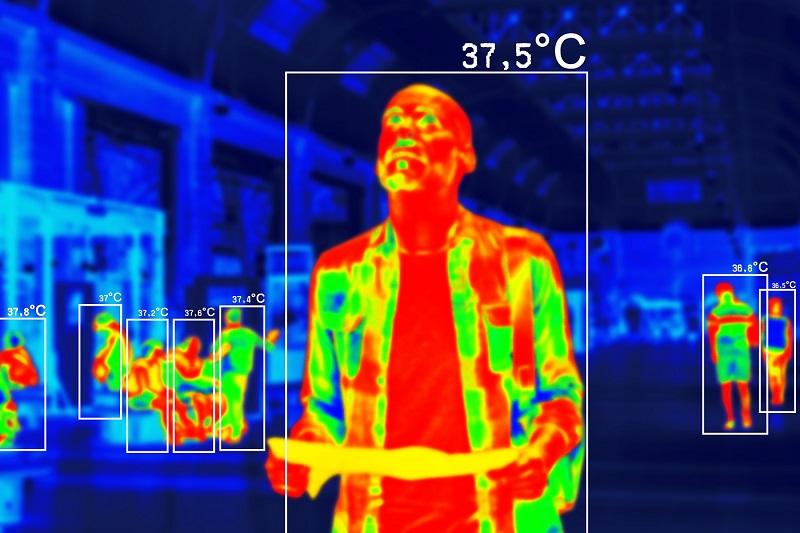

The intelligent thermal screening ecosystem encompasses diverse technologies, vendors, and deployment models addressing health security requirements. The AI Based Fever Detection Camera Market includes fixed installation cameras providing permanent screening at facility entry points. Portable handheld devices enable flexible deployment for temporary locations and mobile screening operations. Kiosk systems combine thermal cameras with displays and access control creating standalone screening stations. Turnstile integrations automate screening workflows preventing entry of individuals with elevated temperatures. Drone-mounted thermal cameras enable crowd screening in outdoor and large venue environments. Wearable thermal sensors provide continuous monitoring for healthcare workers and high-risk populations. Software platforms centralize data management and analytics across distributed camera deployments. Integration middleware connects thermal screening with building management and security systems. Calibration equipment maintains measurement accuracy through reference temperature verification. Market diversity accommodates varied customer requirements across industries, budgets, and deployment scenarios.

Financial forecasts underscore thermal screening technology's substantial economic expansion potential globally. Industry research indicates the AI-based fever detection camera market will reach USD 16.08 Billion by 2035, demonstrating a compound annual growth rate of 25.22% across the forecast period from 2025 through 2035. This growth reflects sustained demand beyond initial pandemic response investments. Healthcare spending dominates as hospitals and clinics maintain permanent screening infrastructure. Corporate investment accelerates as workplace safety becomes strategic priority and competitive differentiator. Educational institution budgets allocate resources for student and staff protection. Government procurement supports public facility screening and emergency preparedness stockpiling. Transportation sector investment scales with passenger volume recovery and ongoing health vigilance. Hospitality industry adoption addresses guest safety concerns and liability risk management. Entertainment venue spending correlates with event attendance recovery and public gathering resumption. International expansion extends growth as emerging markets prioritize health infrastructure development. Market maturation transitions from emergency procurement to planned infrastructure investment and technology upgrades.

Customer segmentation reveals distinct requirement patterns across industry verticals and organization types. Healthcare facilities prioritize medical-grade accuracy and integration with patient management systems. Corporate offices emphasize employee experience balancing screening effectiveness with minimal workflow disruption. Educational institutions require cost-effective solutions processing high volumes during concentrated arrival times. Manufacturing plants need ruggedized equipment withstanding harsh industrial environments. Retail environments seek unobtrusive screening maintaining welcoming customer atmospheres. Transportation hubs demand high-throughput systems processing thousands of individuals hourly. Government facilities require secure systems with strict data protection and privacy compliance. Entertainment venues need portable solutions for temporary event deployments. Small businesses seek affordable entry-level systems with simple installation and operation. Segment-specific requirements drive product differentiation and vertical market specialization among vendors and solution providers.

Competitive dynamics feature established security and medical device manufacturers alongside specialized thermal imaging companies. Traditional security camera vendors extend product portfolios incorporating thermal screening capabilities. Medical device manufacturers leverage regulatory expertise and healthcare customer relationships. Specialized thermal imaging companies focus exclusively on temperature detection applications. Artificial intelligence platform providers contribute software enhancing basic thermal camera functionality. System integrators design comprehensive solutions combining cameras with access control and facility management. Distribution partners extend manufacturer reach into regional markets and vertical industries. Reseller networks provide local installation, service, and support capabilities. Cloud platform providers offer software-as-a-service thermal screening solutions. Consulting firms guide technology selection and deployment strategy development. Market competition intensifies as thermal screening transitions from emergency response to permanent infrastructure. Differentiation occurs through accuracy, ease of use, integration capabilities, and total cost of ownership.

Explore Our Latest Trending Reports:

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness