Gummy Vitamins Market Forecast: Global Demand Surge in Vegan and Sugar-Free Formulations

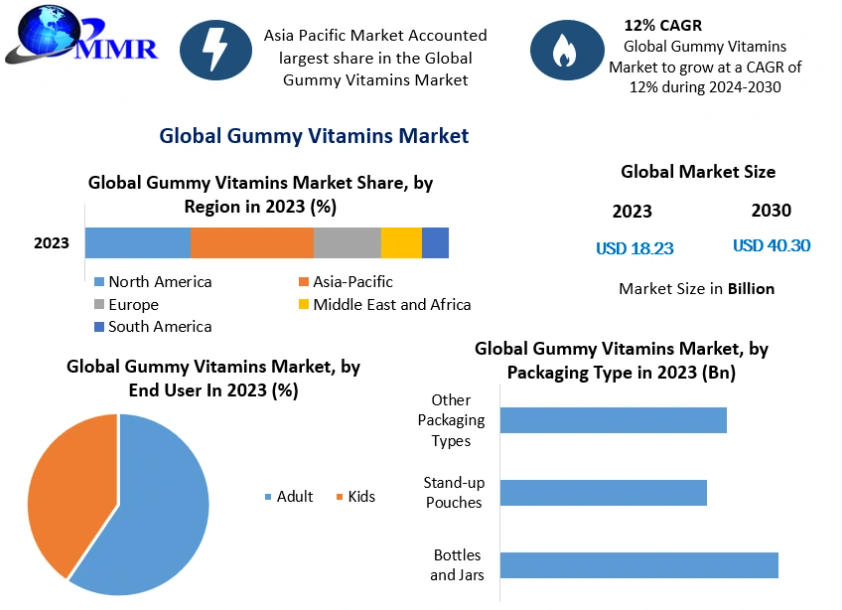

Gummy Vitamins Market was valued at USD 18.23 Bn. in 2023. The Global Gummy Vitamins Market size is estimated to grow at a CAGR of 12% over the forecast period.

Gain Valuable Insights – Request Your Complimentary Sample Now @ https://www.maximizemarketresearch.com/request-sample/112749/

Market Overview

Market Size:

-

2023: USD 18.23 Billion

-

2030 (Forecast): USD 40.30 Billion

-

CAGR (2024–2030): 12%

The Global Gummy Vitamins Market is experiencing robust growth driven by rising health awareness, increasing preference for convenient supplement formats, and innovations in flavor and formulation. These chewable vitamins, similar to candies, appeal to both children and adults due to their taste, portability, and easy consumption.

Market Dynamics

1. Drivers

-

Rising health consciousness: Growing awareness about preventive health and nutrition, especially post-COVID-19.

-

Convenience & taste appeal: Easy-to-chew format and candy-like taste drive adoption among consumers with pill fatigue or swallowing difficulty.

-

Aging population: Geriatric groups prefer easier consumption options for supplements.

-

Millennial demand: Fast-paced lifestyles have increased demand for “on-the-go” supplements.

-

Product innovation: Expansion in multivitamin formulations and diverse flavors boosts repeat purchase rates.

Impact: These factors are collectively propelling market penetration across developed and emerging economies.

Feel free to request a complimentary sample copy or view a summary of the report: https://www.maximizemarketresearch.com/request-sample/112749/

Restraints

-

High production costs: Naturally sourced vitamins and complex gummy formulations increase cost compared to tablets/capsules.

-

Raw material volatility: Limited availability of vitamin A, D, and E sources affects pricing stability.

-

Synthetic vitamin dominance: Dependence on petroleum-based inputs may raise sustainability concerns.

-

Premium pricing: Gummy vitamins are priced higher than conventional supplements, limiting reach in low-income demographics.

Impact: Cost-related barriers may restrain expansion in price-sensitive markets.

Opportunities

-

Flavor & shape innovation: Expansion into fruit-based, sugar-free, and organic variants.

-

Vegan & clean-label trends: Rising demand for gelatin-free, non-GMO, and allergen-free gummies.

-

E-commerce growth: Online distribution channels are rapidly increasing sales reach, especially for premium and niche brands.

-

Functional diversity: Companies are developing gummies for sleep support, skin health, immunity, and energy.

-

Regional potential: Asia-Pacific and Latin America show untapped opportunities due to growing disposable income and awareness.

Trends

-

Organic & natural formulations: Brands like Vitafusion Organic and Nutranext expanding clean-label portfolios.

-

Strategic acquisitions: Clorox’s acquisition of Nutranext and Church & Dwight’s portfolio expansion reflect consolidation trends.

-

Celebrity & influencer marketing: Increasing consumer trust via lifestyle branding.

-

Sugar-free innovations: Addressing diabetic and calorie-conscious consumers.

-

Customized nutrition: Move toward personalized gummy supplements using data-driven health profiling.

Market Segmentation Analysis

By Packaging Type

-

Bottles & Jars (Dominant): Preferred for protection and durability; easy storage and transportation.

-

Stand-up Pouches: Gaining traction for cost efficiency and sustainability.

-

Others: Sachets and blister packs emerging for single-serve applications.

By Distribution Channel

-

Store-based (Leading): Pharmacies, supermarkets, and health stores remain the major sales points.

-

Non-store-based: Rapid growth in online retailing through Amazon, brand websites, and direct-to-consumer models.

By End User

-

Adults (Largest segment): Driven by lifestyle-related deficiencies, stress, and dietary gaps.

-

Kids: Strong potential due to child-friendly flavors and shapes, though parental preference for sugar-free variants is rising.

Dive deeper into the market dynamics and future outlook: https://www.maximizemarketresearch.com/request-sample/112749/

Regional Insights

Asia Pacific (APAC) — Leading Growth Region

-

Market share (2023): ~25%

-

Key growth drivers: Rising health awareness, large undernourished population, and strong economic expansion.

-

High potential markets: India, China, Japan, and South Korea.

-

Forecast: Fastest CAGR during 2024–2030.

North America

-

Mature market: High adoption of dietary supplements; innovation-driven growth.

-

US Dominance: Home to leading brands like Church & Dwight, Nature’s Bounty, SmartyPants, and Olly.

Europe

-

Steady growth: Driven by clean-label and vegan formulations, particularly in the UK, Germany, and France.

South America & MEA

-

Emerging markets: Increasing awareness and expanding retail networks create long-term growth opportunities.

Competitive Landscape

Key Players:

-

Church & Dwight Co. Inc. (US)

-

The Nature's Bounty Co. (US)

-

SmartyPants Inc. (US)

-

Hero Nutritionals, LLC (US)

-

Herbaland Naturals Inc. (Canada)

-

Olly Public Benefit Corporation (US)

-

Life Science Nutritionals (Canada)

-

IM Healthcare (India)

-

Bettera Brands LLC (US)

-

ZanonVitamec Inc. (US)

Frequently Asked Questions about Gummy Vitamins Market

1] What segments are covered in the Gummy Vitamins Market report?

2] Which region is expected to hold the highest share in the Gummy Vitamins Market?

3] What is the market size of the Gummy Vitamins Market by 2030?

4] What is the forecast period for the Gummy Vitamins Market?

5] What was the market size of the Gummy Vitamins Market in 2023?

More Related Reports

global bioherbicides market https://www.maximizemarketresearch.com/market-report/global-bioherbicides-market/68389/

Raisins Market https://www.maximizemarketresearch.com/market-report/global-raisins-market/29649/

Turmeric Oleoresin Market https://www.maximizemarketresearch.com/market-report/turmeric-oleoresin-market/190666/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness